Recently, the share market was hit up with a new product. Yes, we are talking about Smallcase! Smallcase is a considerably new investment product challenging the investors to make more bold decisions. While, Indian market is still trying to increase the participation of people in mutual funds, having Smallcase is making share market investments more interesting yet confusing.

Let’s see, where does the theme base Smallcase stand before the seasoned Mutual funds in this comparative analysis between Mutual Funds Vs Smallcase.

This article aims to help you grasp the basics of Smallcase funds and mutual funds, guiding you to discover the best investment option for your needs.

. Stay steady while we explore the grounds of Smallcase Vs Mutual Fund together!

What is Smallcase Investment?

Smallcases are like mutual funds investments which are a group of stocks combined together in a cluster. Each cluster or fund is designated to one sector, industry, or say follows the investment portfolio of any other big investor, company or sector.

These clusters or smallcase investment funds are curated by financial experts licensed by SEBI, and are based on the trends, risk factors, investment amount, expected ROI etc. So, how do you invest in them?

How Do You Invest in Smallcase Funds?

SEBI regulates smallcase funds. You can invest in them through a demat account or any trading account. You also get the option to choose between a SIP model or a lump sum model for investments. The minimum amount varies with the smallcase clusters.

The next question comes to mind if you have to pay any additional fees to broker or transaction charges? Yes, you have to pay a broker charger, transaction fee or trading fee based on the agreeable percentage. Also, a registration charge of INR 100 to 150 is also to be paid for trading.

A lot of decision making power is in your hands. For instance, you can make changes in the portfolio based on performance at any given point of time. You can sell stocks, hold them or change the investment weightage for different stocks in smallcase.

Other than that, there is no lock in period. So, you can sell them whenever you like.

That was some basic input about smallcase. Let’s see what is a mutual fund, so you can comprehend the comparison between Mutual funds Vs Smallcase, later in the blog.

What is a Mutual Fund?

Mutual funds are a way of investing in products like securities, bonds, debt instruments, equity, etc. In mutual funds, the investment is collected from investors, which is invested in various assets. The investors receive gains from their investments over a period of time, which is managed by financial experts, advisors, etc.

So, how is a mutual fund different from Smallcases?

How is a Smallcase Different From a Mutual Fund?

Well, Smallcase and Mutual funds are poles apart in various ways. However, there are 10 factors that stand out the most. These 10 factors are control over investment portfolio, diversification, expense ratio, holding pattern, capital, risk, etc.

10 Things to Know Before Investing in Mutual Funds Vs Smallcase

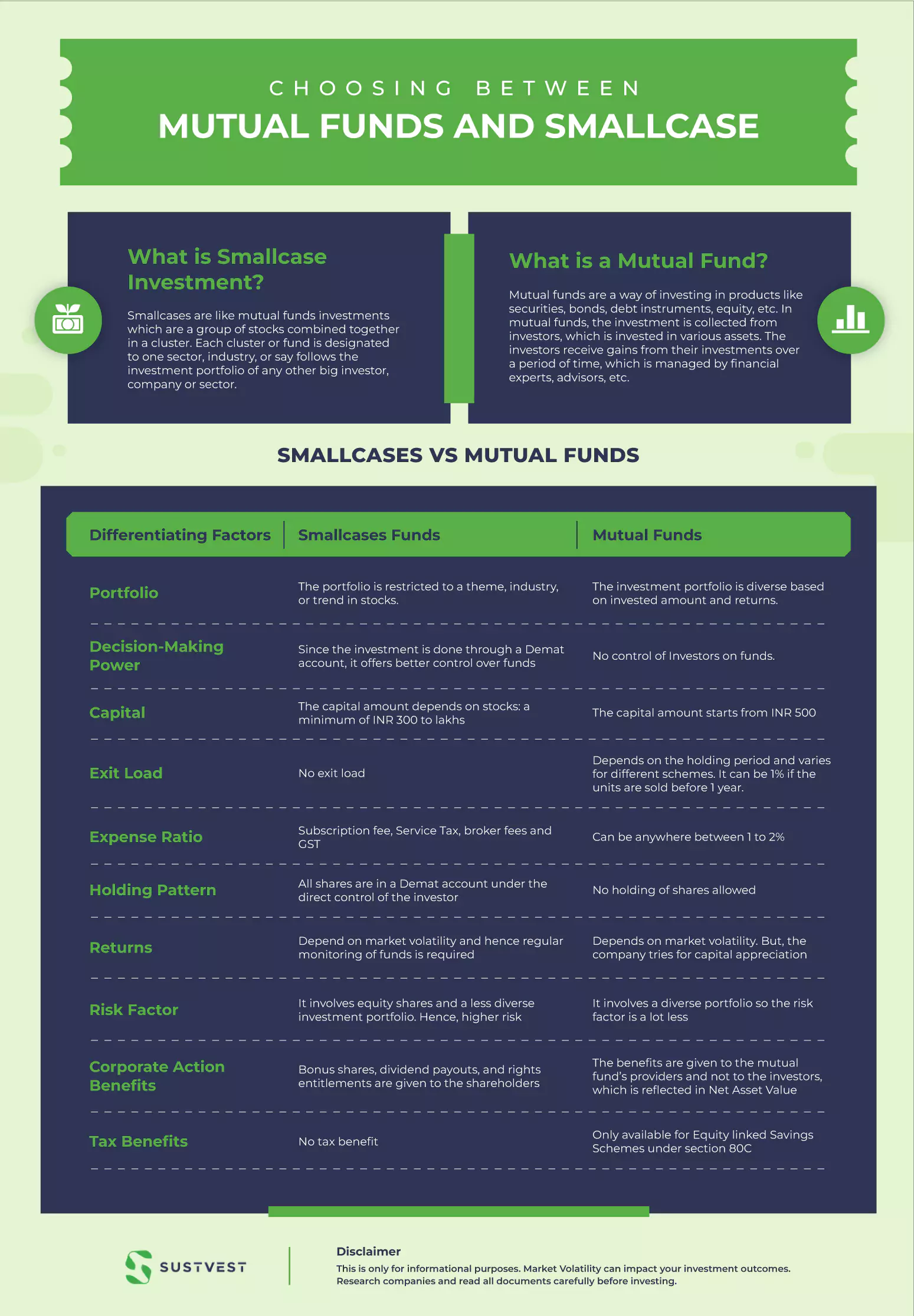

Let’s discuss the comparison of Smallcase funds Vs Mutual funds with respect to the 10 factors briefly in the chart below.

Smallcase Funds Vs Mutual Funds | |||

Differentiating Factors | Smallcase Funds | Mutual Funds | |

| 1 | Portfolio | The portfolio is restricted to a theme, industry, or trend in stocks. | The investment portfolio is diverse based on invested amount and returns. |

| 2 | Decision-Making Power | Since the investment is done through a Demat account, it offers better control over funds. | No control of Investors on funds. |

| 3 | Capital | The capital amount depends on stocks: a minimum of INR 300 to lakhs. | The capital amount starts from INR 500. |

| 4 | Exit Load | No exit load. | Depends on the holding period and varies for different schemes. It can be 1% if the units are sold before 1 year. |

| 5 | Expense Ratio | Subscription fee, Service Tax, broker fees and GST. | Can be anywhere between 1 to 2%. |

| 6 | Holding Pattern | All shares are in a Demat account under the direct control of the investor. | No holding of shares allowed. |

| 7 | Returns | Depend on market volatility and hence regular monitoring of funds is required. | Depends on market volatility. But, the company tries for capital appreciation. |

| 8 | Risk Factor | It involves equity shares and a less diverse investment portfolio. Hence, higher risk. | It involves a diverse portfolio so the risk factor is a lot less. |

| 9 | Corporate Action Benefits | Bonus shares, dividend payouts, and rights entitlements are given to the shareholders. | The benefits are given to the mutual fund’s providers and not to the investors, which is reflected in Net Asset Value.. |

| 10 | Tax Benefits | No tax benefit. | Only available for Equity linked Savings Schemes under section 80C. |

Which is the Best Investment Option: Smallcase vs Mutual Fund?

Both investment options are worth investing in for people adapted to their volatility, capital requirement and decision-making perks. Mutual funds and Smallcases, both require a thorough knowledge of stocks and trading.

In Smallcase investments, financial experts watch over the trends and dips of the market and share their insights to help you make better decisions. But, the final decision to sell, hold or buy falls on your shoulders. It is a good thing for a seasoned share market investor.

While as a mutual fund investor, you are in a back seat to wait and watch for a favorable outcome. The diverse portfolio is an advantage that favors mutual funds over Smallcases. Investors who invest in Smallcases often have a few mutual funds in their kitty.

One crucial factor that distinguishes Smallcases and mutual funds is the expense ratio. The expense ratio is the different kinds of fees an investor has to pay to invest in equity, debt funds or Smallcases.

In fee based smallcase, the expense ratio majorly includes the subscription fee, broker fee and GST(on fee and brokerage). The subscription fee is paid monthly, quarterly or annually. Now, all these fees often affect the ROI of your investment. How? Well, many times for a higher investment amount the expense ratio itself costs more than the returns. Say, you invested INR 60,000 in Smallcases and have paid a subscription fee of INR 12,000. Then, to avail any benefit your Smallcase portfolio must deliver return at min 20% at the least just to recover the subscription fee. So, even if your Smallcases ROI is 22% most of it is consumed in recovering the fee.

Meaning, even though Smallcases offers better transparency, control, etc the profit is at the expense of expense ratio. So, you can invest in a Smallcase for better returns, if the expense ratio amount is less than 4 to 5% of the total investment amount. Avoid Smallcases if you are afraid of higher risk investments.

Before going all out in share market investment for either Smallcase Vs Mutual Fund, ask this:

- What’s your risk appetite? Can you handle lower dips in shares?

- Do you have a backup fund to support you?

- Are you financially stable to take higher risks or can do better with less risk?

- Do you have a thorough knowledge of the targeted Smallcase or mutual fund?

- Are you good at making investment decisions in the share market?

When you are satisfied with the answers, go ahead and steer the investment wheels. Pick a decent Smallcase cluster of stocks or mutual funds which caters to your investment beliefs: sustainability, cause and motive. Start with little and then witness the growth gradually.

Did you get the answer, which is better for you?

FAQs: Mutual Funds Vs Smallcase

Is Smallcase tax free?

No Smallcases are not tax free. They are taxed under short-term and long-term capital gains. If the LTCG is more than INR 1 lakh, it is taxed at 10%. For STCG (less than a year), 15% is charged.

Can I exit from Smallcase at any time?

There is no lock-in period in Smallcases. So, you can exit at any time.

What are the Limitations of Mutual Funds?

- Market Risks: Mutual funds are subject to market fluctuations, and the value of investments can go up or down based on market conditions.

- Fees and Expenses: Investors may incur fees such as management fees and expenses, impacting overall returns.

- Lack of Control: Investors delegate decision-making to fund managers, reducing personal control over individual investment choices.

- Tax Implications: Capital gains distributions and taxes can affect the after-tax returns of mutual fund investments.

What is the difference between mutual funds and mutual smallcase?

Is Smallcase better than mutual funds? Smallcase allows you to invest in a customized portfolio of stocks, Exchange Traded Funds (ETFs), or other instruments based on a theme or strategy. It offers more flexibility and direct control over your investments compared to mutual funds, where a fund manager makes decisions for a larger pool of investors.

With Smallcase, you can tailor your portfolio to specific preferences, potentially offering more personalized and transparent investment options.

Conclusion of Smallcase Vs Mutual Fund

Smallcase investments are a better option for a market savvy, high risk appetite and financially stable investors. Whereas, mutual funds are for beginner investors who want to learn the ropes of share market investment.

No doubt Smallcases appear more attractive due to better control, transparency and independence. But, a less diverse portfolio, higher risk and expense ratio affects its returns negatively. On the other hand, the investors of mutual funds can pick the portfolios based on their risk appetite and have to pay a considerably low expense ratio, without much stress.

In conclusion to Smallcase Vs Mutual Fund it can be said that both the investment products are for different kinds of investors. However, one can start their investment journey with the mutual funds and then with time and experience, can switch to Smallcases.

If you are looking for a less stressful, low risk investment option, explore investments in solar energy sector also. SustVest offers a variety of solar projects through PPA. Learn more about them here.

Founder of Sustvest

Hardik completed his B.Tech from BITS Pilani. Keeping the current global scenario, the growth of renewable energy in mind, and people looking for investment opportunities in mind he founded SustVest ( formerly, Solar Grid X ) in 2018. This venture led him to achieve the ‘Emerging Fintech Talent of the Year in MENA region ‘ in October 2019.