What are AIFs? Alternative investment fund (AIF) is an investment vehicle that pools together money from multiple investors to invest in non-traditional assets such as venture capital, startups, private equities, debt funds, real estate investment trusts (REITs), and other alternative investments.

Particularly high net worth individuals and institutions, including uber-rich investors and family-owned businesses, find investment opportunities in such unconventional funds. as it requires a high amount of investment compared to any retail investment.

Since its inception in 2012, the AIF has risen to 885, a 42-fold jump within a decade from 21 in 2012. The minimum limit to invest is 1 crore, however, for directors, employees, and fund managers, it is reduced to 25 lakh.

What Are the Different Categories of Alternative Investment Funds?

Before delving into what income tax implication on AIF investors, it is important to understand the types of AIFs. SEBI has further divided alternative investment funds into three categories:

Category -1 (CAT I)

These AIF funds invest in new SME businesses and startups that support economic growth and social causes. The government supports investing in such funds due to their ability to create jobs and develop the economy. Furthermore, startups including solar, wind, and biogas, can also help generate environmental returns.

Examples of category-1 AIF funds are as below.

- Venture capital funds (including angel funds)

- SME Funds

- Social Venture Funds

- Infrastructure funds

Category – 2 (CAT II)

Category-2 is by far the most popular category, with the most AIFs registered. Unlike Category 1, these funds primarily invest in unlisted yet established companies that only raise debt or equity from HNIs and FPIs to meet day-to-day operating expenses.

Examples of Category -1 AIF funds are as below.

- Debt funds

- Fund of funds

- Private Equities

Category-3 (CAT III)

This category invests in funds to achieve short-term investment returns using various complex strategies, such as hedging. They have only two types of funds namely, hedge funds and private investment in public equity.

To know more about AIF in India, click here –How To Invest In Alternative Investment Funds In India To Boost Your Revenue Stream?

How Are Alternative Assets Taxed?

Category-1 and 2 alternative investment funds have a pass-through status, meaning whether there is a profit or loss, the income generated by the funds will be paid by the unit holder, i.e., the investor, and not the AIF. In the case of business income, AIF is liable to pay tax.

It’s important to note that the tax is applicable based on duration. For long-term capital gains, the applicable tax rate is 20%. If the duration is short, 15% of the short-term capital gain tax will be applied.

Other charges include surcharges, cess charges, and 10% tax deducted at source.

Since category-3 AIFs don’t have a pass through status, taxes are payable by the AIF for four different types of income. Thus, investors are exempted from paying any tax on the profits they made from these categories.

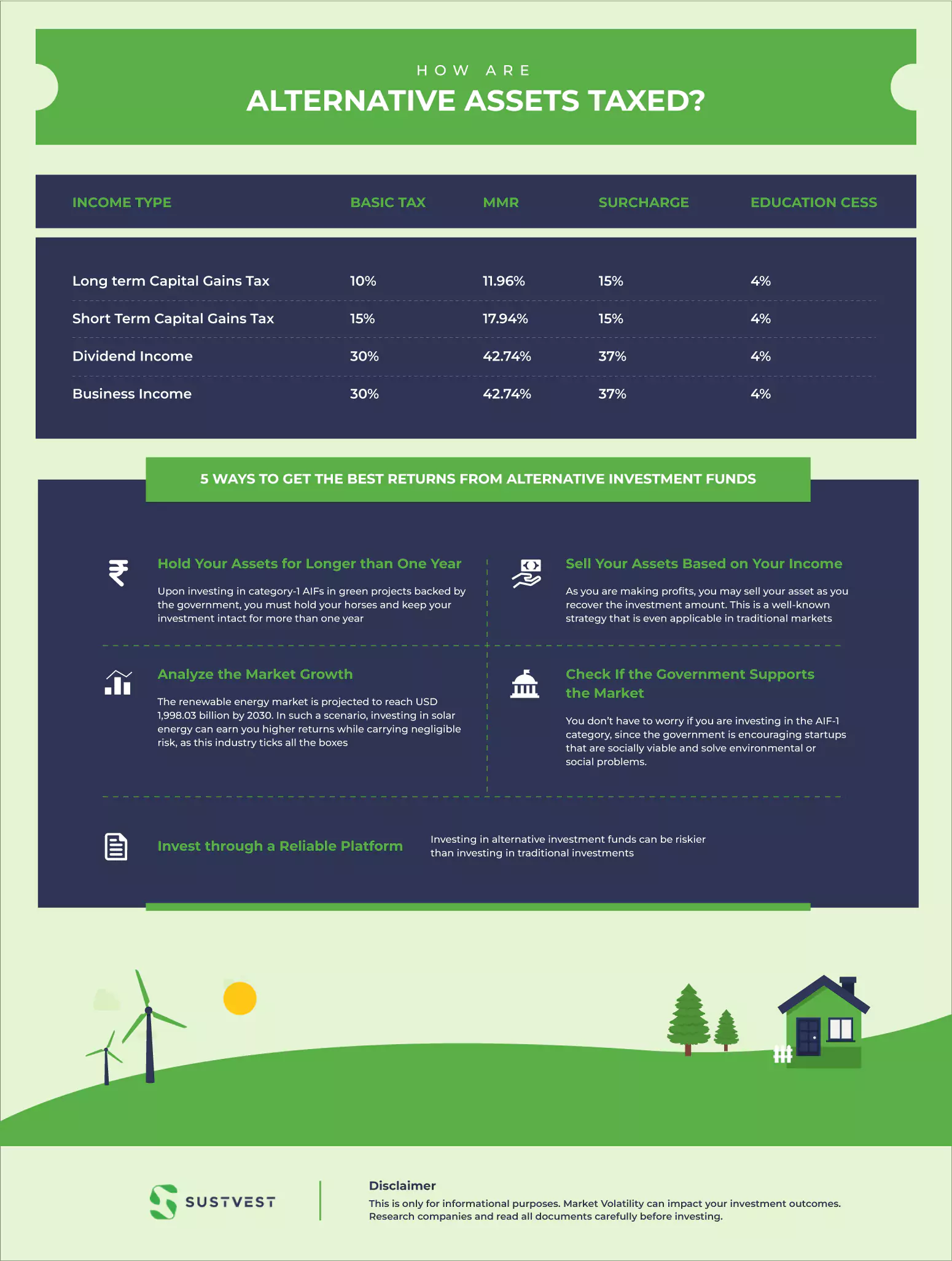

Taxes payable by AIF for Category-3 are described below in the table.

| Income Type | Basic Tax | MMR (Maximum Marginal Rate) | Surcharge | Education cess |

| Long term Capital Gains Tax | 10% | 11.96% | 15% | 4% |

| Long-term Capital Gains Tax | 15% | 17.94% | 15% | 4% |

| Dividend Income | 30% | 42.74% | 37% | 4% |

| Business Income | 30% | 42.74% | 37% | 4% |

For more details on different investment alternatives, check out our blog- What Are the Different Investment Alternatives Available to an Investor?

5 Ways to Get the Best Returns from Alternative Investment Funds

Alternative investment funds are a compelling investment option for high net worth individuals seeking high returns while taking minimal risk. We’ve put together five tips to get the best returns on your AIF investments. By following these strategies, you can make the most of this investment option and achieve your financial goals.

- Hold Your Assets for Longer than One Year

Upon investing in category-1 AIFs in green projects backed by the government, you must hold your horses and keep your investment intact for more than one year. This is because such investments often take time to mature and generate returns, as the projects they invest in typically involve long-term initiatives that require time to develop and become profitable.

By holding onto your investment for longer than one year, you increase your chances of earning higher returns in the long run.

- Sell Your Assets Based on Your Income

As you are making profits, you may sell your asset as you recover the investment amount. This is a well-known strategy that is even applicable in traditional markets.

Assume you invest in an AIF that focuses on financing the installation of rooftop solar panels on residential and commercial buildings. As solar panels generate electricity, the AIF earns revenue and distributes profits to its investors.

As the AIF’s solar projects begin to generate profits, you may want to consider selling some of your assets to recover your initial investment amount.

- Invest through a Reliable Platform

Investing in alternative investment funds can be riskier than investing in traditional investments. Therefore, if you are new in the AIF space, you need to invest through a reliable platform that has a track record of success and is transparent about its investment strategy and performance. Like Sustvest, an alternative investment platform that lets you access all the information about projects from investors, financial documents, and due diligence, to power purchase agreements.

- Check If the Government Supports the Market

You don’t have to worry if you are investing in the AIF-1 category, since the government is encouraging startups that are socially viable and solve environmental or social problems.

Investing in such AIFs may also receive concessions and grants from the government, which can further boost their returns.

- Analyze the Market Growth

The renewable energy market is projected to reach USD 1,998.03 billion by 2030. In such a scenario, investing in solar energy can earn you higher returns while carrying negligible risk, as this industry ticks all the boxes.

With Sustvest, you can invest in promising solar projects across the world with investments ranging from 5000 INR up to 25 lakh INR. You can expect your return to soar as high as 15%.

FAQs: Alternative Investment Funds

- Who can invest in Alternate Investment Fund?

Indian nationals, NRIs, and foreign nationals can invest in NRIs.

- What are the registration fees paid by an AIF?

The registration fee for alternative investment funds (AIFs) varies based on the category of the fund. Category I AIFs are required to pay a registration fee of Rs. 5,00,000, while Category II AIFs have a registration fee of Rs. 10,00,000. Category III AIFs have the highest registration fee of Rs. 15,00,000.

In addition, angel funds, which are a subcategory of Category I AIFs that invest in start-ups and early-stage ventures, have a lower registration fee of Rs. 2,00,000.

- Is AIF regulated by SEBI?

Yes, alternative investment funds are regulated by the Securities and Exchange Board of India. SEBI regulates AIFs through a regulatory framework that includes guidelines for their registration, operation, and disclosure requirements.

- What is the minimum investment in AIF?

The minimum investment amount for alternative investment funds can change depending on the fund’s category. For Category-I AIFs, the minimum investment is Rs. 25 lakhs to Rs. 1 crore, while Category-II AIFs have a minimum investment amount of Rs. 1 crore to Rs. 10 crores, and Category III AIFs have a minimum investment amount of Rs. 1 crore or more.

6. How is AIF taxed in India?

In India, the taxation of Alternative Investment Funds (AIFs) varies based on their category:

Category I and II AIFs: These are treated as pass-through entities, with income and capital gains taxed at the individual investor’s rate. There’s no Dividend Distribution Tax (DDT).

Category III AIFs: Unlike Categories I and II, Category III AIFs are not pass-through entities. They are taxed at the fund level, with a flat tax rate applied to their income. Investors may receive dividends or gains after tax, effectively resulting in double taxation at the fund and individual investor levels.

Please consult a tax advisor for precise details and any changes in tax regulations.

Take Away

While investing in alternative investment funds carries higher risks compared to conventional investing options, it also offers the potential for positive returns over a longer period of time.

Additionally, AIFs tend to have lower volatility than shares and mutual funds. Therefore, incorporating AIFs into your investment strategy can provide diversification to your portfolio, making it a reliable approach to investing.

Sustvest provides attractive opportunities to invest in renewable energy projects with guaranteed returns. If you are still skeptical about this investment option, contact us at [email protected], and we’ll help you find the ideal alternative investment option with our solar financing projects.

Founder of Sustvest

Hardik completed his B.Tech from BITS Pilani. Keeping the current global scenario, the growth of renewable energy in mind, and people looking for investment opportunities in mind he founded SustVest ( formerly, Solar Grid X ) in 2018. This venture led him to achieve the ‘Emerging Fintech Talent of the Year in MENA region ‘ in October 2019.