Introduction:

During these turbulent times, having a well-prepared emergency fund can be your ray of financial hope. In this comprehensive guide on how to create emergency fund India, we will not only delve into the fundamental aspects of what constitutes an emergency fund but also explore its profound significance. We’ll discuss where to wisely invest your emergency fund and shed light on the numerous advantages it brings. So, let’s embark on this journey toward financial security with a more personal and relatable touch.

What is an Emergency Fund?

Before we dive into the intricacies of constructing an emergency fund, let’s take a moment to grasp its essence. An emergency fund is like your very own financial safety net—a reserve of funds specifically set aside to handle unexpected expenses or financial crises that may arise. It’s essentially your financial guardian angel, ready to provide support when life’s monetary storms come your way

Importance of an Emergency Fund

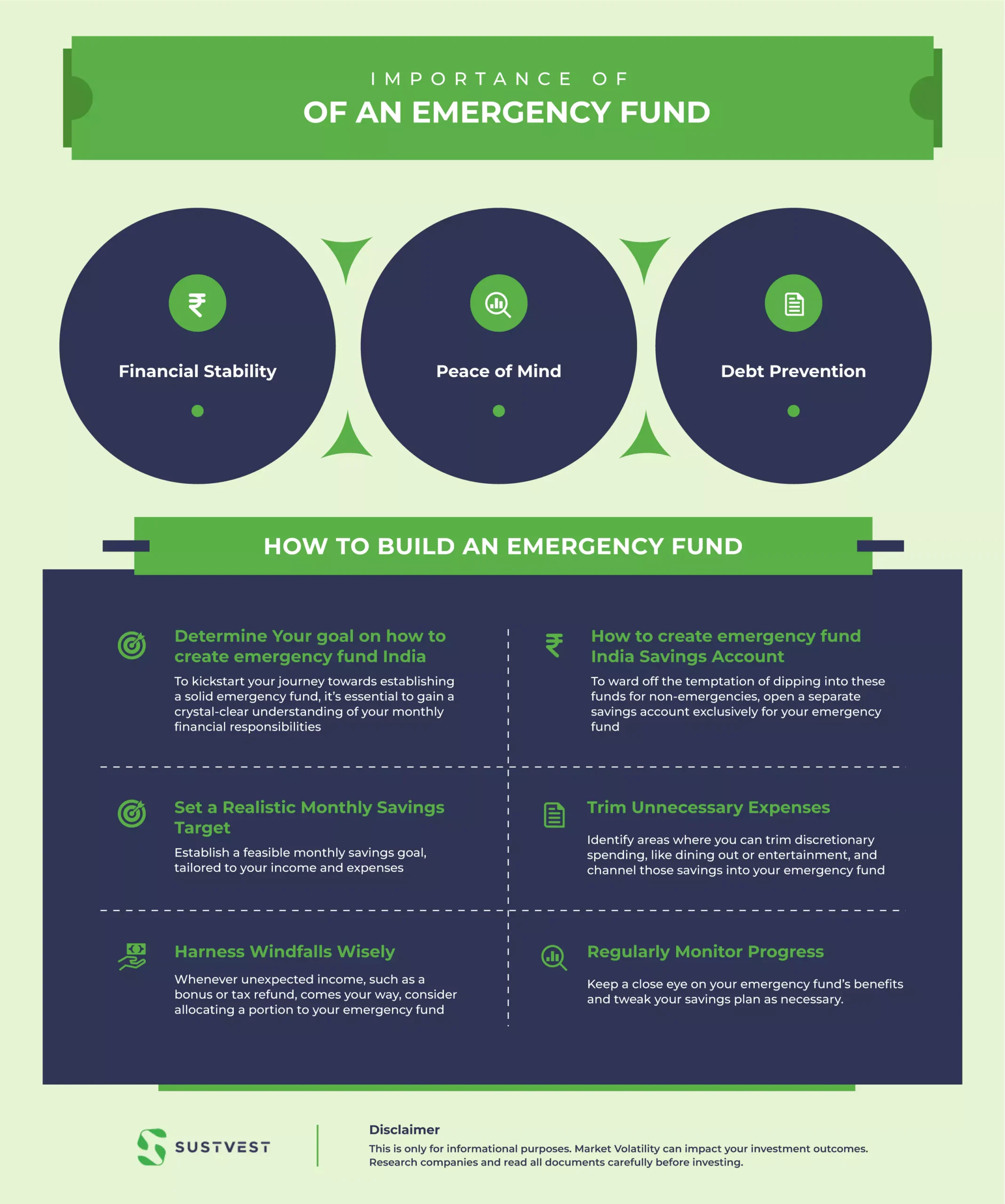

Now, let’s unravel why having an emergency fund is not just a financial strategy but a lifeline:

1. Financial Stability

A stable emergency fund ensures you’re never caught off guard by the curveballs life throws your way. It safeguards your long-term investments, preventing you from depleting them in times of crisis

2. Peace of Mind

Knowing you have a financial cushion brings tranquillity, reducing the anxiety that financial uncertainties can trigger. It instils confidence in you to face financial challenges head-on.

3. Debt Prevention

An emergency fund benefits shields you from accumulating high-interest debts, such as credit card debt, to meet unexpected expenses.

How to Build an Emergency Fund

Building an emergency fund requires meticulous planning and discipline. Here’s a step-by-step guide to help you understand how to create emergency fund India on the path to financial resilience:

1. Determine Your goal on how to create emergency fund India:

To kickstart your journey towards establishing a solid emergency fund, it’s essential to gain a crystal-clear understanding of your monthly financial responsibilities. This encompasses the indispensable expenditures such as rent or mortgage payments, utility bills, groceries, and insurance premiums. These financial pillars constitute the very foundation of your monthly budget, representing the essential costs necessary to uphold your standard of living.

Now, as you contemplate setting a specific target for your emergency fund, it’s commonly advised to strive for accumulating a reserve equivalent to at least 3 to 6 months worth of these routine living expenses. This prudent approach on how to create emergency fund India creates a robust financial cushion, assuring you of a substantial safety net should unforeseen financial challenges unexpectedly come your way.

Whether it manifests as an abrupt medical expense, a vital car repair, or even the unforeseeable loss of employment, possessing this financial buffer provides not only peace of mind but also the assurance of financial stability during times of uncertainty.

2. How to create emergency fund India Savings Account

To ward off the temptation of dipping into these funds for non-emergencies, open a separate savings account exclusively for your emergency fund

3. Set a Realistic Monthly Savings Target

Establish a feasible monthly savings goal, tailored to your income and expenses. Automate transfers from your primary account to your emergency fund account to ensure consistency

4. Trim Unnecessary Expenses

Identify areas where you can trim discretionary spending, like dining out or entertainment, and channel those savings into your emergency fund

5. Harness Windfalls Wisely

Whenever unexpected income, such as a bonus or tax refund, comes your way, consider

allocating a portion to your emergency fund

6. Regularly Monitor Progress

Keep a close eye on your emergency fund’s benefits and tweak your savings plan as necessary.

Should an Emergency Fund Be Liquid?

Absolutely, an emergency fund should be highly liquid, meaning you should have quick and penalty-free access to the money. Consider parking your emergency fund in a savings account or a money market account where you can withdraw funds without hassle.

Where to Invest Your Emergency Fund

While liquidity is paramount, it’s also important to make your emergency fund benefits work for you. Here are some options for how to create emergency fund India

1. High-Interest Savings Account

Hunt for savings accounts offering competitive interest rates to help your emergency fund grow gradually

2. Fixed Deposits

Consider putting a portion of your emergency fund benefits in fixed deposits, which typically offer higher

interest rates than regular savings accounts.

3. Liquid Mutual Funds

Liquid mutual funds strike a balance between liquidity and returns, making them a viable option for your emergency fund

4. How to create Emergency Fund India Sweep Accounts

Some banks offer sweep accounts that automatically transfer excess funds from your savings account into higher-yield investments, ensuring liquidity and potential growth.

Emergency Fund Benefits

Now, let’s unpack the myriad benefits of how to create emergency fund India

1. Financial Security

Your emergency fund serves as a financial safety net, bolstering your stability when unexpected expenses come knocking.

2. Reduced Stress

The knowledge that you have a financial cushion reduces stress and anxiety, empowering you to tackle challenges more confidently.

3. Debt Avoidance

With an emergency fund at your disposal, you can sidestep the pitfalls of accumulating high-interest debt to meet emergencies

. 4. Financial Flexibility

Armed with the Importance of emergency fund, you can make informed financial decisions without feeling rushed or cornered.

FAQs

Let’s address some common questions about emergency funds:

Q1: Are emergency funds long-term or short-term?

A1 :Emergency funds are typically considered short-term savings, designed to cover immediate financial emergencies.

Q2: Should you save for a separate emergency fund?

A2: yes, it’s imperative to maintain a distinct emergency fund to prevent it from mingling with your regular savings or investments

Q3: How should I plan my emergency fund transfer?

A3 : your transfers by setting up an automated monthly transfer from your primary account to your dedicated emergency fund account, ensuring consistency in your savings.

Conclusion

In the journey of life’s uncertainties, The comprehensive guide of how to create emergency fund India stands as your unwavering ally, offering financial security, peace of mind, and the ability to navigate turbulent times with grace. We hope this guide has not only clarified the essence of an emergency fund but also empowered you to embark on the path toward financial resilience. So, start building your emergency fund today, and for expert guidance connect with Sustvest today. Your future self will undoubtedly thank you for this prudent financial decision.

Founder of Sustvest

Hardik completed his B.Tech from BITS Pilani. Keeping the current global scenario, the growth of renewable energy in mind, and people looking for investment opportunities in mind he founded SustVest ( formerly, Solar Grid X ) in 2018. This venture led him to achieve the ‘Emerging Fintech Talent of the Year in MENA region ‘ in October 2019.