Let’s say your investment portfolio not only yields returns but also contributes towards saving the planet. Sounds like a win-win, doesn’t it?

This is the power of green energy investment. It’s more than a financial decision; it’s a step towards embracing sustainability and battling climate change.

So, what happens when you invest in renewable energy companies? We’re going to explore this exciting new frontier, spotlighting renewable energy investment in India. We will light the path to a greener future from the potential benefits to the challenges.

India, with its vast potential, stands poised for an energy revolution in a world urgently needing a shift from fossil fuels.

Investing in renewable energy is not just a wise financial move but also a chance to be part of a transformation that’s as promising for the earth as it is for your wallet. Join us, and be part of this journey.

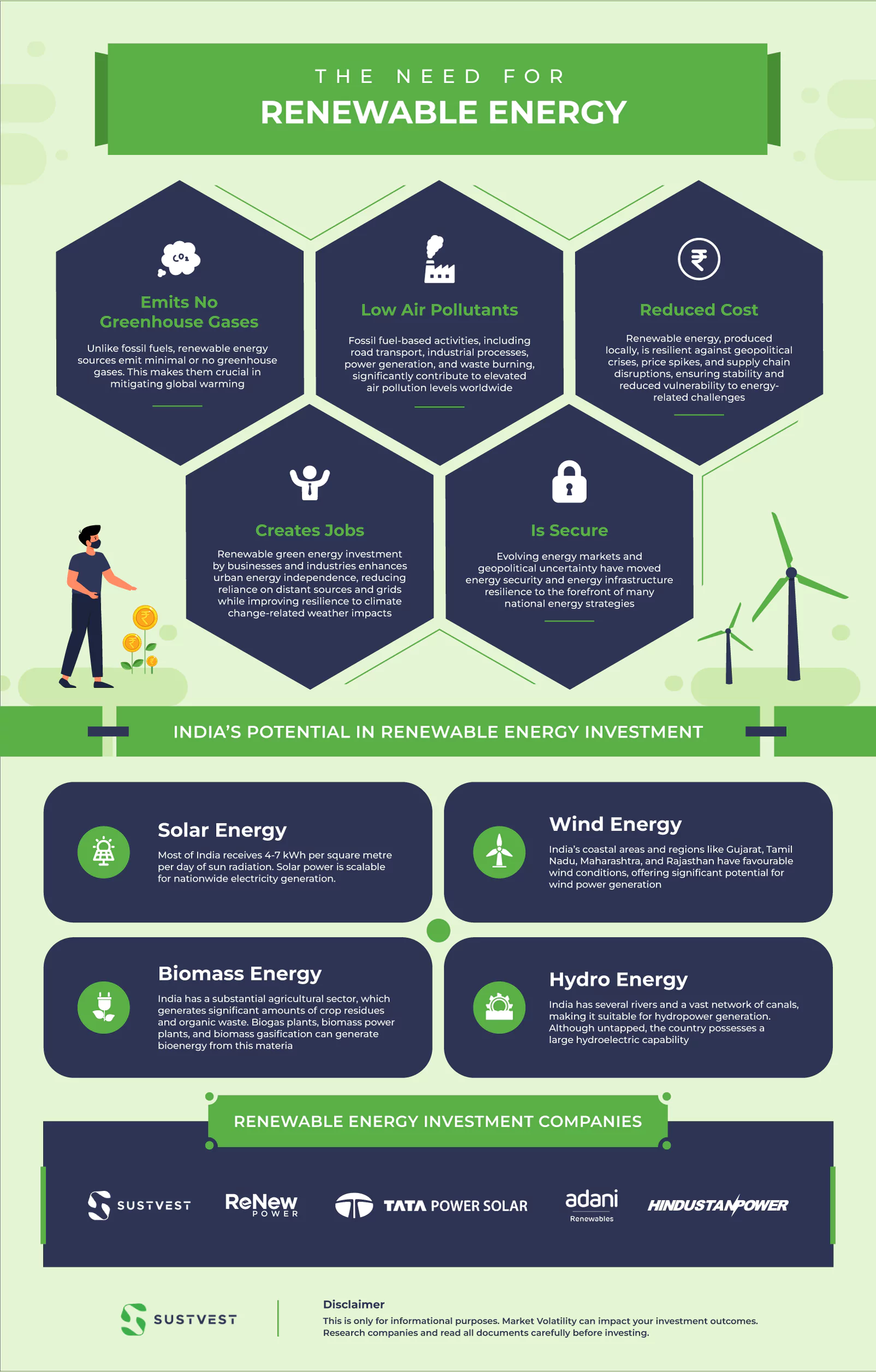

The Need for Renewable Energy

Renewable energy sources, like any human activity, do have environmental impacts. But their advantages over fossil fuels are undeniable.

They offer reductions in water and land use, minimise air and water pollution, mitigate wildlife and habitat loss, and emit little to no greenhouse gases.

Moreover, their localised and decentralised nature, along with technological advancements, bring significant economic and societal benefits.

- Emits No Greenhouse Gases: Unlike fossil fuels, renewable energy sources emit minimal or no greenhouse gases. This makes them crucial in mitigating global warming. Even when considering the entire life cycle of renewable technologies, their emissions remain significantly lower.

- Low Air Pollutants: Fossil fuel-based activities, including road transport, industrial processes, power generation, and waste burning, significantly contribute to elevated air pollution levels worldwide. According to the World Health Organisation, this pollution causes poor indoor and outdoor air quality, which kills millions and costs billions.

- Reduced Cost: Renewable energy, produced locally, is resilient against geopolitical crises, price spikes, and supply chain disruptions, ensuring stability and reduced vulnerability to energy-related challenges.

- Creates Jobs: Renewable green energy investment by businesses and industries enhances urban energy independence, reducing reliance on distant sources and grids while improving resilience to climate change-related weather impacts.

- Is Secure: Evolving energy markets and geopolitical uncertainty have moved energy security and energy infrastructure resilience to the forefront of many national energy strategies. Energy markets globally, from the EU and the US to Egypt and India, worry about supply security.

Renewable Energy Investment Companies

With millennials showing a preference for renewable energy, the brand’s commitment to sustainability influences consumer choices.

In India, renewable energy companies are actively promoting non-conventional energy resources and corporate social responsibility.

As India’s population and energy demands rise, the energy sector aligns with millennial interests by emphasising green energy.

Numerous reputable renewable energy companies have emerged in India, showcasing commendable performance in harnessing renewable energy resources.

Here is a list of the top green energy investment companies in India

ReNew Power Ventures

ReNew Power Ventures is a prominent renewable energy production player specialising in wind and solar resources. The company has experienced remarkable growth since its inception.

Notably, Global Environment Fund, Abu Dhabi Investment Authority, and Goldman Sachs have invested in ReNew Power, reinforcing its status as a renewable energy pioneer.

This significant influx of green energy investment has solidified ReNew Power’s position as a leader in the renewable energy sector.

Tata Power Solar Systems Ltd.

Tata Power Solar is a division of the renowned Tata Group. It is a major player in India’s solar energy market and has made considerable strides in green energy investment.

The company has achieved significant milestones by prioritising research and development, resulting in reduced solar energy costs and enhanced efficiency.

Tata Power Solar has completed nationwide solar rooftops, parks, and power facilities. Tata Power Solar has pioneered a sustainable energy future in India with its unique approach and devotion to renewable energy.

Sustvest

Sustvest is a leading renewable energy investment company committed to driving the transition to a sustainable future. With a focus on renewable energy projects, Sustvest actively invests in solar, wind, hydro, and other clean energy ventures.

By supporting innovative and environmentally responsible initiatives, Sustvest aims to contribute to global efforts in combating climate change and fostering a greener planet.

With their expertise and dedication, Sustvest provides investors with opportunities to align their financial goals with positive environmental impact.

Adani Renewables

With a clear vision for the future, this firm aims to be the leading player in the renewable energy sector by 2030. Recently, the company bolstered its expansion plans by acquiring Inox Wind and Essel Group, significantly boosting its solar and wind assets.

The company is poised to increase its current capacity of 2.5 GW to an impressive 18 GW by 2025, solidifying its position as a major contributor to India’s green energy transition.

Hindustan Power

Hindustan Power India’s renewable energy leader, with 6000MW of operating capacity. The company’s solar and wind energy concentration shows its dedication to sustainable development.

Hindustan Power not only prioritises business interests but also upholds strong corporate social responsibility principles, ensuring the protection of stakeholders while contributing to environmental conservation. The company’s strategic green energy investment aims to green India and the world.

India’s Potential in Renewable Energy Investment

To address the challenges posed by fossil fuel dependency, India is increasingly focusing on green energy investment. Coal, oil, and natural gas dominate India’s energy landscape. These sources have supplied most of the nation’s energy for decades.

However, dependency on fossil fuels contributes to air pollution, greenhouse gas emissions, and energy security concerns.

Coal highly dominates India’s energy mix. Coal has helped fulfil India’s expanding electricity needs but is also polluted and unhealthy. Oil and natural gas use is prominent in transportation, industry, and residential sectors.

India possesses immense potential for renewable energy due to its geographical location, diverse climate, and large landmass.

- Solar Energy: Most of India receives 4-7 kWh per square metre per day of sun radiation. Solar power is scalable for nationwide electricity generation.

- Wind Energy: India’s coastal areas and regions like Gujarat, Tamil Nadu, Maharashtra, and Rajasthan have favourable wind conditions, offering significant potential for wind power generation. The country has the fourth-largest installed wind power capacity globally.

- Biomass Energy: India has a substantial agricultural sector, which generates significant amounts of crop residues and organic waste. Biogas plants, biomass power plants, and biomass gasification can generate bioenergy from this material.

- Hydro Energy: India has several rivers and a vast network of canals, making it suitable for hydropower generation. Although untapped, the country possesses a large hydroelectric capability.

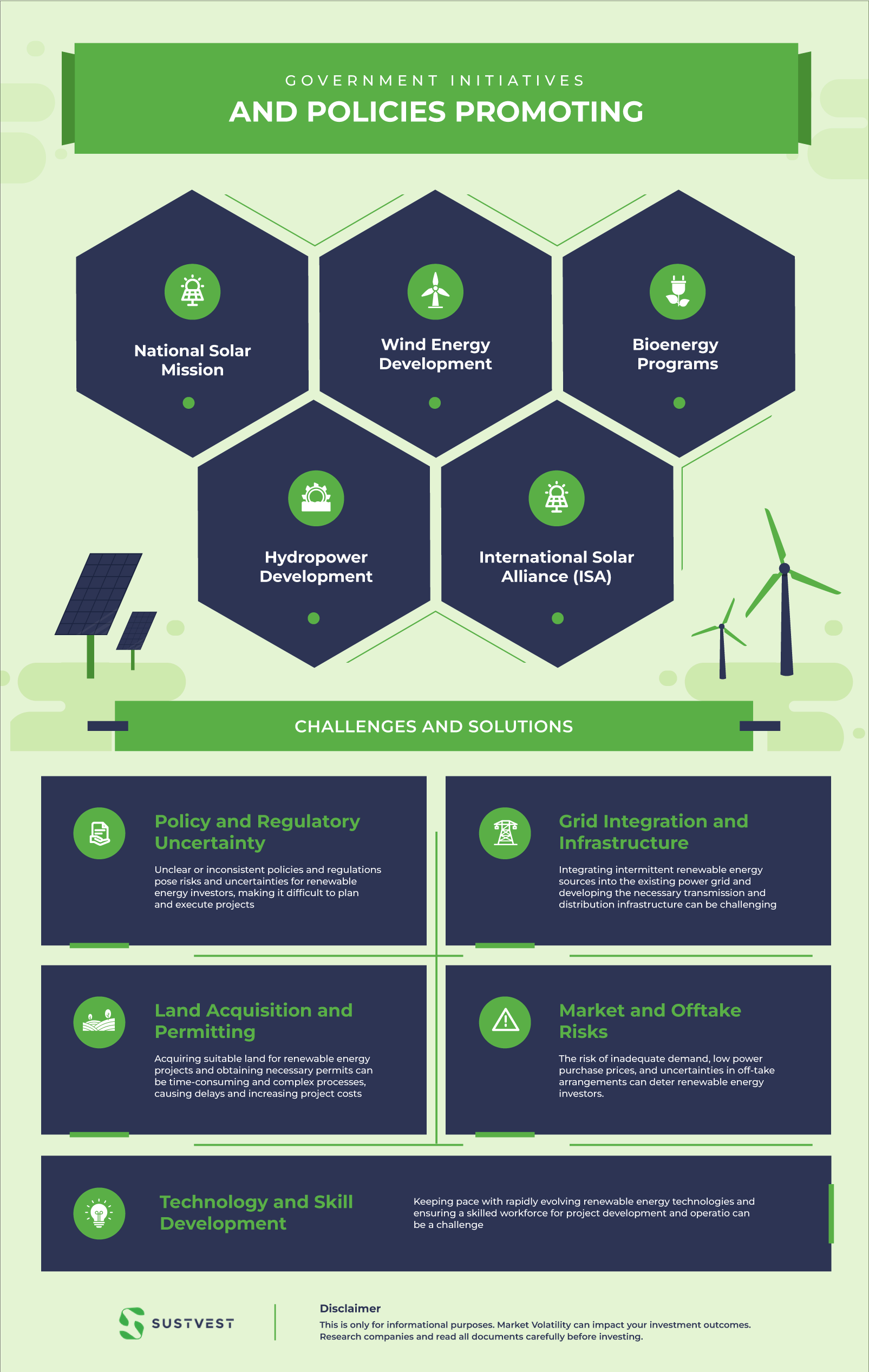

Government Initiatives and Policies Promoting Renewable Energy Investment

Green energy investment, particularly in solar, is driven by government initiatives. Government policies have a significant impact on solar energy adoption. Policies such as Renewable Portfolio Standards (RPS) can create a secure market for solar power, encouraging investment.

Tax breaks and subsidies can lower installation costs, increasing accessibility. However, policies that impose high permission costs or restrict net metering can deter investment and diminish the financial advantages of solar energy.

The Indian government is implementing several steps to boost renewable energy production and investment. Some notable ones include:

- National Solar Mission

- Wind Energy Development

- Bioenergy Programs

- Hydropower Development

- International Solar Alliance (ISA)

These government actions and regulations have helped India’s renewable energy sector thrive, drawing domestic and foreign investment and creating a favourable climate.

Opportunities in Renewable Energy Investment in India

India presents significant opportunities for green energy investment. The country’s ambitious renewable energy targets, favourable policy environment, and abundant renewable resources create a conducive investment climate.

The government’s focus on initiatives like the National Solar Mission, wind energy development, bioenergy programs, and hydropower development provides incentives and support for investors.

India’s growing energy consumption and desire to cut carbon emissions and increase energy security create investment opportunities.

Indian renewable energy investors seek infrastructure development, project funding, technology implementation, and partnerships.

Challenges and Solutions in Renewable Energy Investment

Addressing the challenges through a combination of supportive policies, financial incentives, robust infrastructure development, streamlined processes, and market mechanisms can help attract and sustain renewable energy investment, fostering the transition to a clean and sustainable energy future.

1. Policy and Regulatory Uncertainty

Unclear or inconsistent policies and regulations pose risks and uncertainties for renewable energy investors, making it difficult to plan and execute projects.

Solution: Governments need to establish stable and transparent policy frameworks, including long-term targets, feed-in tariffs, and power purchase agreements. Regular policy reviews and updates can ensure alignment with changing market dynamics and investor interests, providing a predictable investment environment.

2. Grid Integration and Infrastructure

Integrating intermittent renewable energy sources into the existing power grid and developing the necessary transmission and distribution infrastructure can be challenging.

Solution: Governments should invest in grid infrastructure upgrades, smart grids, and energy storage technologies to enable better integration and management of renewable energy. Encouraging public-private partnerships can facilitate the development of transmission lines and grid infrastructure in remote areas with high renewable potential.

3. Land Acquisition and Permitting

Acquiring suitable land for renewable energy projects and obtaining necessary permits can be time-consuming and complex processes, causing delays and increasing project costs.

Solution: Governments can streamline land acquisition procedures, designate specific zones for renewable energy development, and provide a clear and efficient permitting process. Engaging local communities and addressing their concerns through transparent consultation processes can help overcome resistance to land acquisition.

4. Technology and Skill Development

Keeping pace with rapidly evolving renewable energy technologies and ensuring a skilled workforce for project development and operation can be a challenge.

Solution: Governments can drive innovation and cost reductions in renewable energy technologies through green energy investment in research and development. They should also promote skill development programs, vocational training, and academic courses to build a skilled workforce for the renewable energy sector.

5. Market and Offtake Risks

The risk of inadequate demand, low power purchase prices, and uncertainties in off-take arrangements can deter renewable energy investors.

Solution: Governments can facilitate long-term power purchase agreements, establish competitive auction mechanisms, and create mechanisms for renewable energy certificate trading. This provides market visibility, price stability, and assured off-take, reducing investment risks.

FAQs

Why should I consider investing in green energy for environmental conservation?

Green energy investment reduces fossil fuel use and combats climate change, creating a cleaner, healthier Earth.

What are the potential financial returns of investing in green energy?

Green energy investments can provide attractive financial returns, with the growing demand for renewable energy and government incentives fostering a favorable investment environment.

What are the risks associated with investing in green energy?

Like any investment, green energy investments carry risks. Factors such as policy changes, market volatility, and technological advancements can influence returns. It’s important to conduct thorough research and diversify investments.

Are there any government incentives or subsidies available for green energy investment?

Many governments worldwide offer incentives, subsidies, and tax benefits to promote green energy investment. These incentives can vary by country and region, so it’s advisable to explore local programs to maximize potential benefits.

Conclusion

Green energy investment is essential for environmental preservation. This article has highlighted the significant role that companies investing in renewable energy are playing in safeguarding our planet. We saw the huge renewable energy investment opportunity in India.

We can fight climate change and conserve ecosystems by using renewable resources and sustainable practices. Green energy investment must be prioritised by enterprises, governments, and individuals.

Let us join hands and work towards a sustainable future with organisations like Sustvest leading the way.

Founder of Sustvest

Hardik completed his B.Tech from BITS Pilani. Keeping the current global scenario, the growth of renewable energy in mind, and people looking for investment opportunities in mind he founded SustVest ( formerly, Solar Grid X ) in 2018. This venture led him to achieve the ‘Emerging Fintech Talent of the Year in MENA region ‘ in October 2019.