Are you tired of being held back by traditional funding options with hefty upfront costs and fixed terms? Lease financing might be the game-changing solution you need.

Lease financing offers a unique opportunity for entrepreneurs seeking new avenues for wealth creation. This innovative funding solution enables startups and investors to access capital through agreements that benefit both lessees and lessors.

If you’re curious about lease financing, this all-encompassing guide is your ticket to unlocking a deeper understanding of its potential advantages and limitations.

As you explore lease financing, partnering with a knowledgeable organization like SustVest, dedicated to promoting renewable energy investments, will enhance your business’s growth strategy and make leasing easier.

In this article, we will analyze the advantages, limitations, and various aspects of lease financing, equipping you with the knowledge to make informed decisions and maximize the benefits of this financing option.

Let’s get started, shall we?

What Is Lease Financing?

Lease financing is a powerful tool that allows businesses to use assets without purchasing them outright. It is a contractual agreement between the owner of the assets (lessor) and the user of the assets (lessee).

As the lessee, you get to use the asset while paying a periodical amount in the form of lease rent. The title of goods, however, remains with the owner (lessor) of the asset.

Leasing agreements are customizable to meet your business’s specific needs, including options for maintenance and upgrades.

What Are The Different Types Of Lease Financing?

There are different types of lease financing available to businesses depending on their specific needs and financial situation.

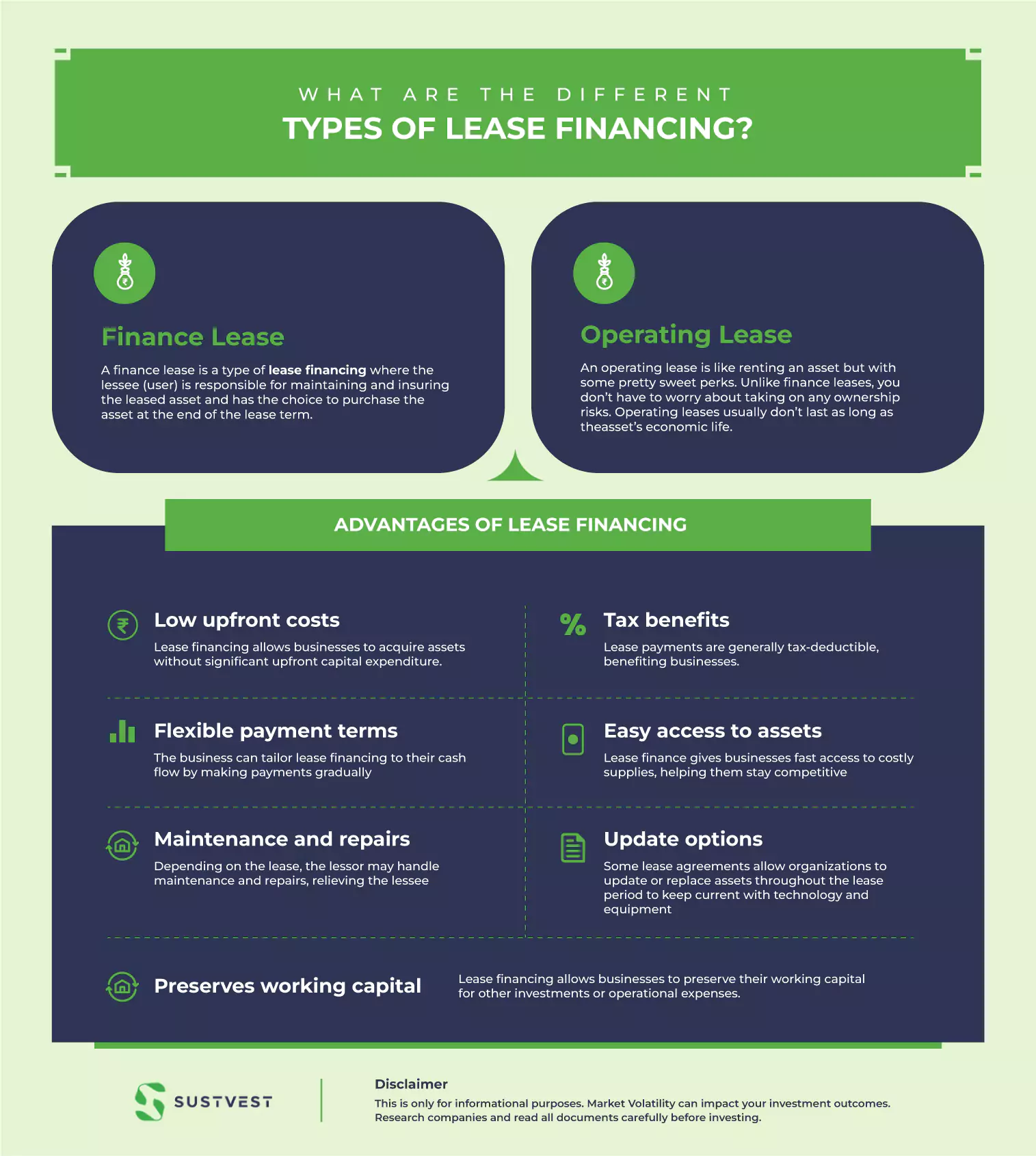

However, the main categories of lease financing are Finance Lease and Operating Lease.

1. Finance Lease

A finance lease is a type of lease financing where the lessee (user) is responsible for maintaining and insuring the leased asset and has the choice to purchase the asset at the end of the lease term.

The lessor (financing company or individual) typically owns the asset and receives regular lease payments from the lessee. Finance leases are a type of debt financing that typically involves longer-term agreements.

Let’s take a closer look at some key features of lease financing- finance lease:

- A finance lease is a device that gives the lessee the right to use an asset for a specified period of time.

- The lease rental charged by the lessor during the primary period of the lease is sufficient to recover their investment.

- After the primary period, the lease rental is often just a “peppercorn rental” – a small fee. The lessee is responsible for any necessary repairs to the leased property.

- The lessor carries no asset-based risk or profit.

- This type of lease is non-cancellable, and the lessor’s investment is assured.

2. Operating Lease

An operating lease is like renting an asset but with some pretty sweet perks. Unlike finance leases, you don’t have to worry about taking on any ownership risks. Operating leases usually don’t last as long as the asset’s economic life.

Also, during the initial part of the lease, the lessor’s investment is not covered by the rent paid. But in most cases, the lessor will advise on how to handle and maintain the leased asset.

Following are highlighted some of the fundamental features of lease financing- operating lease:

- Operating leases are short-term rental agreements that allow a lessee to use an asset for a specific period of time at a fixed cost.

- Operating leases typically last for three years or less, and the lease term is much lower than the asset’s economic life.

- The lessee may terminate the lease on short notice with no penalty.

- The lessor provides the technical know-how of the leased asset to the lessee and bears risks and rewards incidental to the ownership of assets.

- The lessor has to depend on leasing an asset to a different lessee to recover their investment.

- Operating leases provide a flexible and cost-effective solution for businesses looking to reduce their capital expenditures.

Advantages Of Lease Financing

Lease financing can provide several advantages to businesses, making it a popular choice for acquiring assets.

Here are some advantages of lease financing:

- Low upfront costs: Lease financing allows businesses to acquire assets without significant upfront capital expenditure.

- Tax benefits: Lease payments are generally tax-deductible, benefiting businesses.

- Flexible payment terms: The business can tailor lease financing to their cash flow by making payments gradually.

- Easy access to assets: Lease finance gives businesses fast access to costly supplies, helping them stay competitive.

- Maintenance and repairs: Depending on the lease, the lessor may handle maintenance and repairs, relieving the lessee.

- Update options: Some lease agreements allow organizations to update or replace assets throughout the lease period to keep current with technology and equipment.

- Preserves working capital: Lease financing allows businesses to preserve their working capital for other investments or operational expenses.

Limitations Of Lease Financing

Lease financing, while advantageous in many situations, has some drawbacks that businesses should consider before choosing this approach.:

- Long-term cost: For a lease, businesses may have to pay more than the actual asset value due to interest and fees.

- Lack of ownership: Since the lessee doesn’t own the asset, they cannot build equity or claim depreciation tax benefits.

- Strict terms and conditions: Lease agreements can have inflexible terms, such as early termination fees, limited usage, or penalties for excess wear and tear.

- Obligation to pay: Lessees must make lease payments regardless of whether the asset remains useful or productive, which may be problematic during financial downturns.

- Limited customisation: Lease agreements may restrict a business’s ability to customize or modify the leased asset to suit its specific needs.

- Renewal or end-of-lease options: At the end of the lease, companies may face high costs to purchase the asset, renew the lease, or return the asset in the required condition.

Check out our blog on Best Alternative to Mutual Funds here!

What Are The Items I Can Lease For Good Returns?

Leasing is a good option for profitable returns, depending on market demand and the lessee’s needs.

Here are five items you can lease for good returns:

- Solar Panel

- Heavy Machinery

- Transportation Equipment

- Fitness Equipment

- Construction Equipment

With the suited market demand and lessee needs, leasing can be a profitable option for you. Let’s break down each of them below.

- Solar Panel

Leasing is becoming increasingly popular for businesses looking to save money on expensive equipment while maintaining productivity.

Solar panels are in demand because businesses and people want to lower their carbon footprint and energy bills.

Leasing solar panels can provide an affordable way for customers to access this technology and generate income for lessors.

Check out our article “Why Invest In Solar Energy Now” here.

- Heavy Machinery

Heavy equipment is necessary for many industries, but the price tag may be unaffordable for some. The cost of heavy machinery can be a massive hurdle for many companies, especially those who don’t have the resources to purchase new equipment. Renting or leasing can be a cost-effective alternative for those who need the equipment for short-term uses.

Leasing heavy machinery is a practical and financially advantageous way for companies to get this equipment without paying an enormous fee upfront.

- Transportation Equipment

Commercial vehicles and airlines both rely heavily on transportation machinery. Leasing transportation equipment allows firms to add vehicles to their fleet easily, as well as an update to more recent models, without incurring significant financial risk.

- Construction Equipment

Like heavy machinery, construction equipment can be costly to purchase outright.

By leasing construction equipment, construction companies can obtain the necessary tools to complete their projects without using their available capital. Consequently, this frees up their financial resources for other essential business needs.

FAQs Related To Lease Financing

What exactly is lease financing?

Lease financing is a financial arrangement where a business or individual acquires the use of an asset by making periodic payments to the owner (lessor) over a fixed period without purchasing it outright.

How does lease financing differ from a traditional loan?

With lease financing, the lessee only pays for the use of the asset, not its ownership, contrary to a traditional loan that involves borrowing money to purchase the asset and repaying the loan over time with interest.

What are the benefits of lease financing for businesses?

Lease financing can be a game-changer for businesses looking to save money and streamline their operations. By choosing lease financing, you can enjoy lower upfront costs, improved cash flow management, potential tax advantages, flexibility in upgrading assets, and reduced risk of asset obsolescence.

Can individuals utilize lease financing, or is it just for businesses?

Lease financing is not limited to businesses; individuals can use it too, especially for high-value items like automobiles or real estate. It’s a popular option for those who want to use an asset without the long-term commitment or financial burden of ownership.

What happens when a lease expires?

After a lease term, the lessee can return the asset to the lessor, extend the lease, buy the item at a predetermined price, or lease a different one. The option relies on the lessee’s needs and the lease agreement.

Conclusion

Lease financing is a savvy way for businesses and individuals to get their hands on high-ticket items without paying the entire price upfront. This nifty option helps with cash flow management and offers tax savings when acquiring equipment, cars, or property.

By grasping the ins and outs of lease financing, you can make informed decisions that could set you up for financial success. If you’re keen to explore this option, it’s worth consulting with a financial advisor who can guide you through the process.

So why not take advantage of all that lease financing has to offer? Don’t let high upfront costs stand in the way of your goals.

Contact SustVest today and invest in a brighter, sustainable future! With low-risk and asset-based investment options, we make things affordable and accessible for both investors and consumers.

Let’s collaborate toward a better world for all!

Founder of Sustvest

Hardik completed his B.Tech from BITS Pilani. Keeping the current global scenario, the growth of renewable energy in mind, and people looking for investment opportunities in mind he founded SustVest ( formerly, Solar Grid X ) in 2018. This venture led him to achieve the ‘Emerging Fintech Talent of the Year in MENA region ‘ in October 2019.