The portfolio management industry has grown in the Indian market over the last few years.

According to the research conducted by the SEBI, the assets under management, which are under portfolio management, have seen tremendous growth from RS 10.45 lakh in March 2016 to around RS 28 crore in March 2023.

In India, the portfolio management industry is estimated to exceed Rs. 50 lakh crore by 2031, which would take a 20% CAGR increase. So it clearly shows the bright future of this industry in India.

If you want to know more about portfolio management, you’re at the right place.

In this guide, we will cover everything about Portfolio management, its types, functions of portfolio management, future scope, and 5 basic wise principles of portfolio management that you must know.

Let’s dive in!

What is Portfolio Management?

Portfolio management manages clients’ portfolios by selecting the right investment tools and strategies. The main focus in portfolio management is balancing minimizing risk and maximizing profits over a specific period. It helps to ensure that the client’s investment is not exposed to too much risk.

Let’s take an example and understand – if you want to explore different investment options like stocks, bonds, or funds. However, you have very limited knowledge regarding investments, markets, and the conditions that can affect the returns of these investments. This is where portfolio management comes to the rescue, which plays a very important role in helping enhance your results by using the right financial strategies in practice.

Read here to know: What is Portfolio Diversification, and Why is it Important?

Types of Portfolio Management

1. Active Portfolio Management

Active portfolio management produces higher investment returns. In active portfolio management, stocks are bought when they are undervalued and sold once they are overvalued.

Active portfolio managers play a crucial role in this approach to active portfolio management, as they scan the stock market consistently to find you the best investment option. Active portfolios involve high risk but give high returns too. If you are not afraid and can embrace risk to lead actively based on your investment, this approach will reap more benefits for you.

2. Passive Portfolio Management

It’s the exact opposite of managing an active portfolio. Passive portfolio management aims to achieve long-term growth while minimizing risks. It’s for those who want to invest in long-term options for capital growth and long-term profitability.

3. Discretionary Portfolio Management

In discretionary portfolio management, you only have to communicate your financial goals and the timeline to the manager or broker, and the rest of the process of finding and investing capital will be handled. So that you can let professionals manage your portfolio and get you high returns.

4. Non-Discretionary Portfolio Management

Non-discretionary is for those who don’t want to hand over their entire portfolio to someone else. In this approach, your manager gives advice regarding your investment options based on current market trends and your financial goals.

Check Out: Long term or short term investment – which is best for you?

5 Basic Principles of Portfolio Management

Following a set of principles of portfolio management has always been essential to achieving long-term financial goals. Let’s learn about what are the principles of portfolio management and have a successful investing experience:

1. A Trusted Financial Advisor is the Need of Hour

Portfolio management is easy and can be done without the advice of a portfolio manager. But this is only true for those with knowledge and interest who can certainly manage things independently. Working with a trusted portfolio manager can be way more effective principle of portfolio management than you think. A professional portfolio manager can help you add value to your investment portfolio by guiding you to invest in the best option that suits your financial goals and timeline. Multiple studies have shown that working with a professional advisor and not being a self-directed investor brings more returns to your investments.

2. Align Your Portfolio With Your Strategy

In 2023, when the companies were finalizing their execution plans, market trends took a flip. The companies had to rework their directions and align strategy to meet the new market trends. The directions and their business goals and objectives were reworked to help portfolio managers build an aligned portfolio with the updated business strategies. Aligning your portfolio with your strategy is the most important principle of the five basic principles of portfolio management. Portfolio alignment is the key to achieving organizational goals and objectives.

3. Keep A Balance In Your Portfolio Against Overall Risk

Risks can be a danger to your portfolio, as they can impact it overnight if your components are not balanced. Suppose the risk components weigh too much and don’t contribute to your goals and objectives; the portfolio is at high risk of failure. Covid-19 is one of the best examples of how risk can impact your portfolio overnight.

4. Avoid Emotions Dictate Your Investment Decisions

Making informed decisions is one of portfolio management’s most crucial basic principles. Making decisions regarding your investments based on fear, greed, or any other emotion can put you at very high risk. Fluctuations are natural, and you need to take them as they are and stick with your plan or make a new one depending on market conditions.

5. Review and Update Your Portfolio Regularly

The principles of a company or organization keep changing, and that’s why the principles of portfolio management state that the portfolio should be revised immediately and according to market conditions. Also, by performing a regular portfolio review, you can verify if the performance of your investments is aligned with the returns you want to receive or the goals you are willing to satisfy.

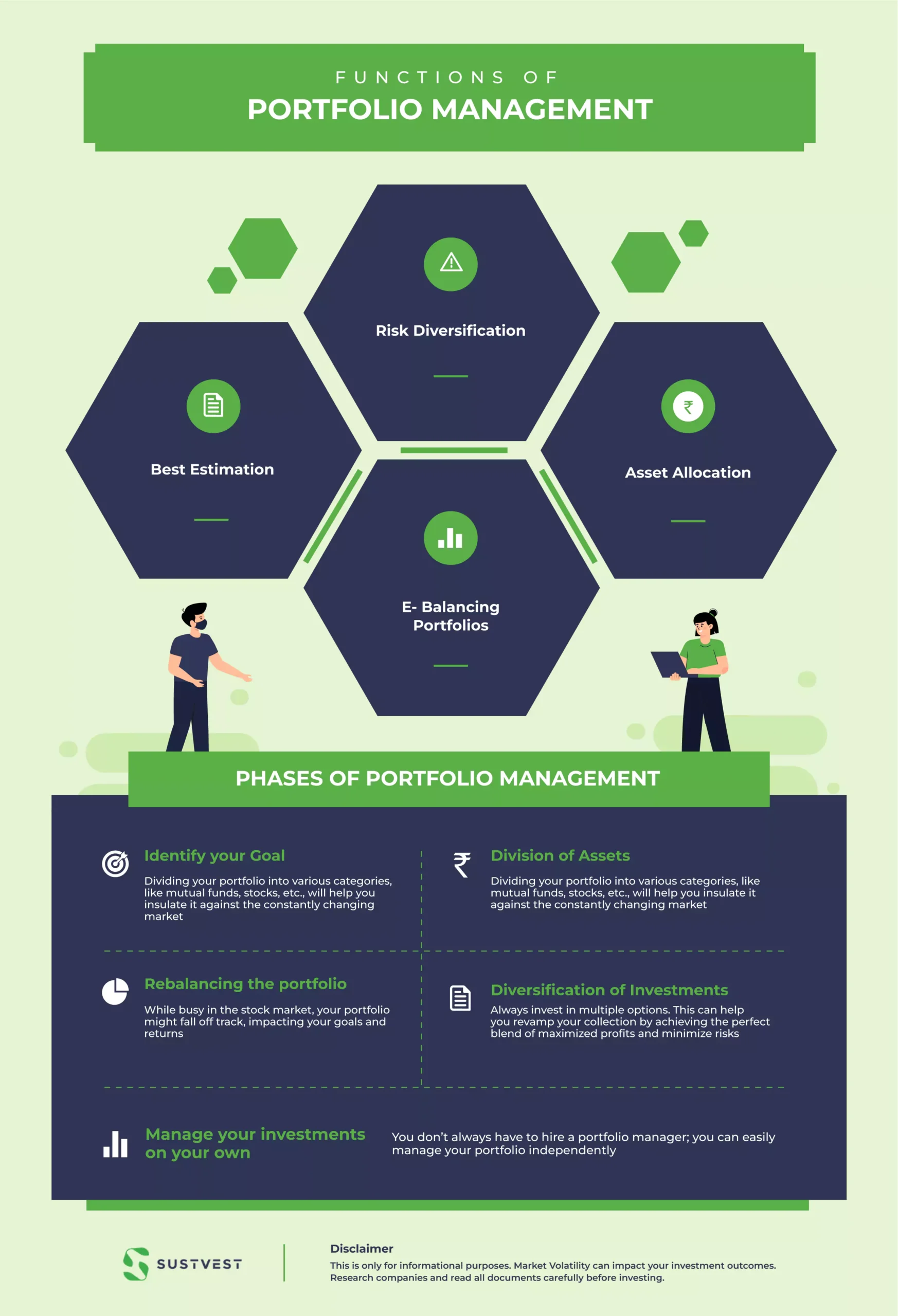

Functions of Portfolio Management

1. Risk Diversification

One of the essential functions of the principles of portfolio management is to spread the risk, similar to the investment of assets. Diversification is a very effective way of diversifying the risk within the stock categories and reducing it.

2. Asset Allocation

The principles of portfolio management have an important function called asset allocation, which deals with the functional balances of investments. In simple terms, equally weighted categories of assets are used to aim for stock bonds.

3. Best Estimation

Another important function of portfolio management principles is estimating the best investment option, which is useful in making an ultimate selection of securities for investments.

4. E- Balancing Portfolios

The functions of portfolio management involve the rebalancing of investment portfolios. Portfolio rebalancing involves periodically adjusting the investment portfolios to maintain their originality. The adjustment can be made in two ways:

- Constant proportion portfolio: In a Constant proportion portfolio, portfolio adjustments are made to maintain the relative weighing according to the price change.

- Constant beta portfolio: Whereas in a Constant beta portfolio, portfolio adjustments are made in such a way as to accommodate the values of component betas in investment portfolios.

Find Out: How to Make a Successful Long Term Investment Decision (2023)?

Phases of Portfolio Management

1. Identify Your Goal

The first step in creating a well-balanced investment portfolio is identifying your financial goals, which will help you earn the desired return within a specific period with minimum risk.

Ask yourself the below questions to determine your goals and plan an effective investment strategy:

- What am I saving for?

- When will I need the money I am investing?

- What do I need to do to meet my financial goals?

2. Division of assets

Dividing your portfolio into various categories, like mutual funds, stocks, etc., will help you insulate it against the constantly changing market. The results of a fruitful allocation depend on the factors mentioned below:

- Your Financial Goals

- Risk Tolerance

- Investing Duration

These three key factors help you select suitable investment options.

3. Rebalancing the portfolio

While busy in the stock market, your portfolio might fall off track, impacting your goals and returns. That is why it is important to keep rebalancing your portfolio. Rebalancing your portfolio helps you bring your investments back on track and align them with your investment strategies and goals. Rebalancing your portfolio every six months or twice a year is advised, as there is no fixed time to rebalance it.

4. Diversification of investments

Always invest in multiple options. This can help you revamp your collection by achieving the perfect blend of maximized profits and minimize risks.

5. Manage your investments on your own

You don’t always have to hire a portfolio manager; you can easily manage your portfolio independently. There are multiple tools and websites available online that can help you find the right investment option. But use it carefully, as technology can help you, but it can’t replace the power of personal research.

FAQs: What are the basic principles of Portfolio management?

What are the types of portfolio management?

Below are the types of portfolio management – Active, Passive, Discretionary, and Non-Discretionary.

Explain the role of portfolio management?

Portfolio management helps investors invest and gain maximum profits with minimum risks.

Who is a portfolio manager?

A portfolio manager is a professional manager responsible for maintaining a client’s investment portfolio.

Conclusion

Portfolio management is a guiding compass for individuals and organizations aiming to meet their financial goals. By adhering to the Principles of Portfolio Management, investors can emphasize creative strategies, lowering risk, and make informed decisions to get stable returns. Renewable energy is a great investment sector for lower-risk, higher returns, and building passive income if you plan to diversify your portfolio. To diversify your portfolio, you can contact SustVest, where experts will help you invest with informed decisions and get stable returns. We hope this article helps you to understand everything about portfolio management and its basic principles.