We all own assets. But, only a few don’t let it become a liability!

Assets and liabilities are a tail of what you own vs what you owe. Think about it, you bought a car. Now, that is your asset as you own it. But, you took a loan to buy it! So, that’s what you owe to the bank. The car is an asset. However, the loan is the liability.

That’s how simple the concept of assets and liabilities is. Although the rise of a credit culture to spend more than you earn has blurred the line between an asset and a liability.

This guide to the top 10 assets that generate income in India 2023 will help you to invest wisely and create a stable financial foundation around you.

First, let’s understand the basic difference between an asset and a liability before we dive into the income generating assets.

Now, assets and liabilities both are part of the balance sheet. The general formula for the calculation of assets is:

Assets = Liabilities + Shareholder’s Equity

Where liabilities are what you have to pay to others like salary, loan, service charges, taxes, operation costs, property taxes, loans, etc.

Shareholder’s equity is the difference between asset and liability, which is the company’s capital or net worth.

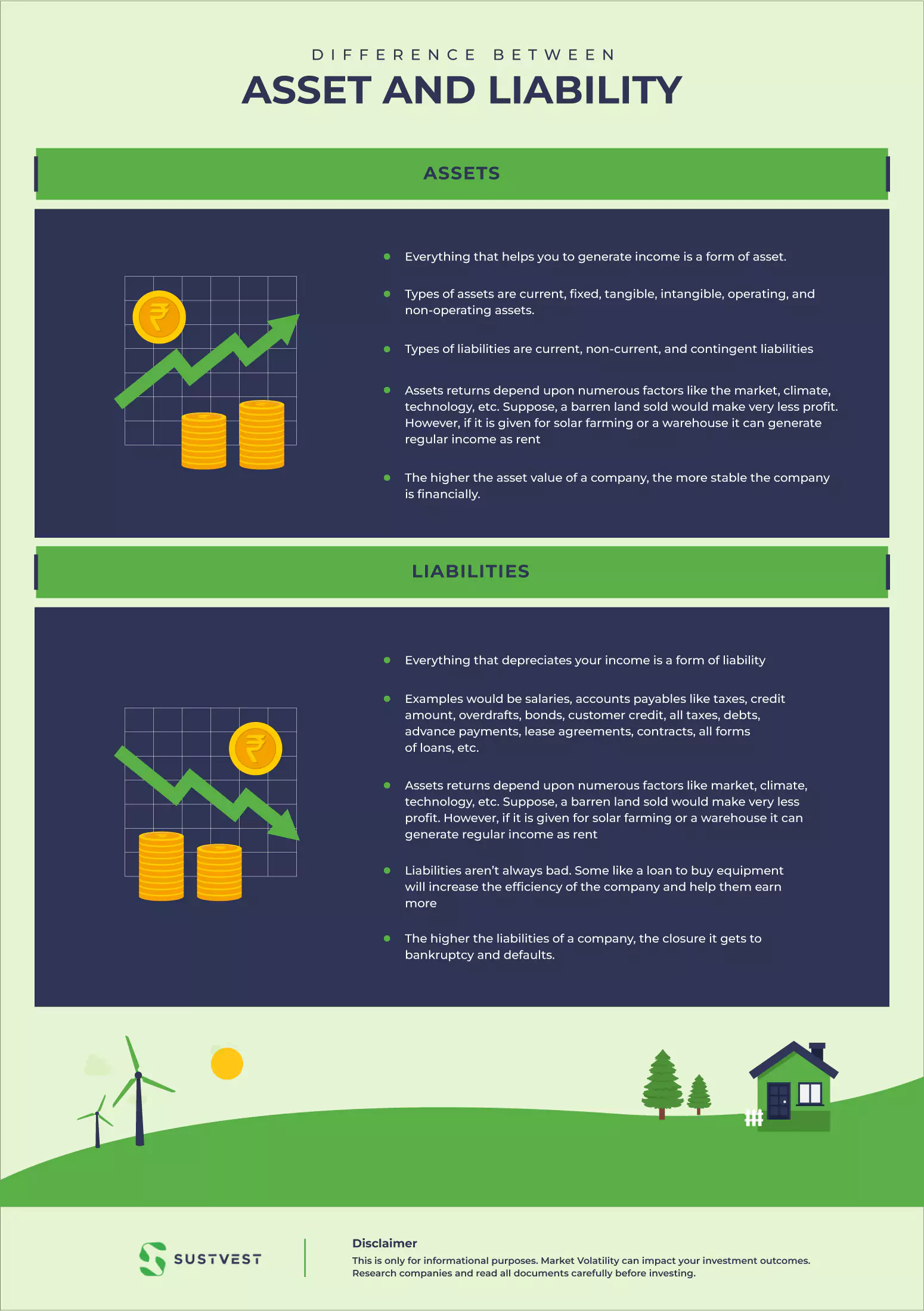

Difference Between Asset And Liability

| Sr. No | ASSETS | LIABILITIES |

| 1 | Everything that helps you to generate income is a form of asset. | Everything that depreciates your income is a form of liability. |

| 2 | Types of assets are current, fixed, tangible, intangible, operating, and non-operating assets. | Examples would be salaries, accounts payables like taxes, credit amount, overdrafts, bonds, customer credit, all taxes, debts, advance payments, lease agreements, contracts, all forms of loans, etc. |

| 3 | Types of liabilities are current, non-current, and contingent liabilities. | Assets returns depend upon numerous factors like market, climate, technology, etc. Suppose, a barren land sold would make very less profit. However, if it is given for solar farming or a warehouse it can generate regular income as rent. |

| 4 | Assets returns depend upon numerous factors like the market, climate, technology, etc. Suppose, a barren land sold would make very less profit. However, if it is given for solar farming or a warehouse it can generate regular income as rent. | Liabilities aren’t always bad. Some like a loan to buy equipment will increase the efficiency of the company and help them earn more. |

| 5 | The higher the asset value of a company, the more stable the company is financially. | The higher the liabilities of a company, the closure it gets to bankruptcy and defaults. |

Understanding what falls under assets and liabilities gets more difficult as you dive into the accounts. Gladly, as an investor you don’t have to. But, if you stumbled upon a balance sheet of any company you have invested in, the left side of the balance sheet shows all the assets and the right side shows all the liabilities.

As a thumb rule, the value of the assets must always be more than the liabilities side. If that’s the case, then rest assured that the company is making profits and you will make some too.

There are a few other numbers that you can check for a better financial understanding of a company’s status. They are the current ratio, acid test ratio, cash ratio, owner’s equity, and debt ratio.

- Owner’s Equity: It is the net worth of a company. It can be calculated using the formula Owner’s equity = Total assets – total liabilities.

- Current ratio: current asset / current liabilities, to estimate the company’s current debt repayment ability.

- Acid test ratio: (current assets – inventories)/ current liabilities, to estimate the company’s ability to pay the short-term liabilities with quick assets.

- Cash ratio: (cash equivalents + cash)/ current liabilities, to estimate the company’s ability to pay the short-term liabilities of cash equivalents and cash assets.

- Debt ratio: total liabilities / total assets, to estimate the total assets of a company bought through debts.

10 Best Assets That Generate Income In India

After looking at the basics of assets and liabilities, now we can move on to a few investment options for assets that generate income. Further, by investing in them you can create a steady income easily.

1. Renewable Energy

The renewable energy asset class has become one of the most promising assets that generate income. It fulfills ESG, SDG, and SRI guidelines meaning the investment aligns with your principles as well as with the common good of all.

A few facts about renewable energy investments. They are generally based on annuity and the term can be from a few months to a few years. You don’t require large capital for investment. You can choose the portfolio of your choice. However, among wind, solar, and hydro, the solar energy sector is flourishing more.

To invest in a solar energy asset you have two options. Either you partner with a green energy platform like Sustvest to start earning steady ROI or you can invest in the share market or green energy mutual funds. The latter is much riskier! Both ways will earn you good returns in the long run.

Here’s a video of the Sustvest –How does our Investment Structure work? You can browse through our website too, click here- Sustvest!

Here are more ideas on how to earn by investing in solar energy.

- Start by becoming a consumer and save on electricity. You can contact Susvest to install high-rise rooftop solar panels and create your own electricity. With the summer heat, the increase in electricity bills is obvious. It is estimated that installing solar panels for a 3BHK can save you approx. INR 36,000 annually.

- Use your spare land as a solar farm and earn monthly income. Solar farms are even promoted by the government under the PLI scheme and PM KUSUM Yojana. You can get a 30% subsidy on the cost of the project.

- Another way is to partner with solar energy platforms and invest in their projects. You can either get a lease or a PPA. The income will be based on a fixed percentage till the maturity period.

2. Rents From Real Estate

Rent from real estate is one of the most lucrative ways to earn a monthly income. Buy a property or construct one by loan. Then, rent it out. From the rent, you can pay the EMI and maintenance costs. Once you have made more bucks than your liabilities, you have got an asset in hand.

Renting also offers a variety of options. For flats and apartments, you can tie up with online platforms like AirBNB, Agoda, MMT, etc, and rent out your property seasonally. This will earn you more income without handing out your property to someone for a whole year.

For a commercial property renting out as an office space, superstore, warehouse, or PG Hostels there are tonnes of options. Take your pick based on the location of your property, which type of business it is suited for, and the type of usage. Based on this you can convert your extra properties into assets that generate income in no time.

3. Business

Businesses are also a viable source of income for many families. At present, India is the third largest start-up-producing country. Till last year, about 1.5 million companies got registered in ROC. With the increasing population, the consumer base in India is also increasing.

You can benefit from it too by starting one of your own. Having a business like a grocery mart, an eatery, cloth merchandise, a transport business, any food merchandise like KFC or a marketing agency, etc are just some options.

Businesses not only help to make you financially independent but also can be left as assets that generate income for your generations as well.

4. Real Estate

Real Estate investments are quite popular in the investment sector. Especially the ones associated with the renewable energy sector. Real estate stock investments or mutual funds are a great way to invest and earn long-term profits. To invest in the Real estate you can take any real estate mutual fund and begin your journey.

5. Certificates Of Deposits (CDs)

Certificates of Deposits are similar to Bonds and help you earn fixed financial returns. They are physical instruments issued by the Reserve Bank of India (RBI) in exchange for a price less than the Face Value of the CD.

The Certificate of Deposits is issued by several commercial banks. Your money will be deposited in an account for a fixed period at a fixed interest rate. So, there is no risk involved.

Just, remember no premature withdrawals are allowed. This is available for all citizens of India including the NRI. The returns earned on CDs are taxable. CDs are considered to be one of the less risky assets that generate income.

6. Royalties

If you are a creative person this might be for you. Royalties are the payment paid by the consumer for using a product or a service to the creator. The products and services vary. Suppose you created a small app and sold it to any third party at a fixed or floating interest rate. The money you earn back is your royalty.

Royalty is earned for using patents, copyrights, trademark secrets, book publishing, etc. Royalties are a very lucrative form of assets that generate income.

7. Corporate Bonds

Just like the government, companies also sell bonds to get funds from retail investors like you and me. These bonds are called Corporate bonds. These are also debt funds, through which the companies cover their short-term fund needs.

The company and the investor undergo an agreement for a fixed period. At maturity, the company pays back the principal amount and the interest on it. The payments can be annually, quarterly, or monthly.

Now, why do people go for bonds as an investment option? It is because they offer a comparatively higher return as compared to fixed deposits and debt mutual funds.

Corporate bonds are not as safe as Government bonds. These assets that generate income are riskier in nature and require research before investing in them. That’s because their interest depends on several factors like RBI repo rate, stock market prices, loss or gain in equity, the demand for bonds in the market, etc.

To understand the risk factor of bonds, the investor must check for the CRISIL value, coupon rate, face value, last traded price (LTP), secured or not, and Yield to Maturity (YTM). Now, except for LTP and YTM all other factors remain the same till maturity.

If the CRISIL value is AAA, it means the bonds are more secure and their chances of defaulting are negligible. Similarly, if the coupon rate is more the chances of return and risks both are high. That’s because the coupon rate depends on the market. It rises and crashes with the market.

Companies like ICICI Direct, Golden Pie, Fixed Income, RBI, and The Wint Wealth help retail investors to buy and sell bonds.

8. Gold Investment

Gold investments in India are a traditional way of creating an asset. You can invest in them in the form of bullion, coins, jewellery, sovereign gold bond, digital gold, Gold Mutual Funds, and Gold exchange-traded funds.

Out of these, sovereign gold bonds are considered the safest form of long-term assets that generate income. You should know that the interest earned at 2.5% on Gold bonds is taxable. The lock-in period of this bond is 5 to 8 years.

9. Equity Mutual Fund

Equity mutual funds can help you invest in multiple companies and diversify your investment portfolio. They are considered high-risk and high-return options. For investments of less than 3 years, equity mutual funds are not recommended.

In equity mutual funds, your money is invested in purchasing the shares or buying equity stocks. You can decide and choose a portfolio for your investment among high, low, and moderate-risk companies’ assets. The fund manager as per your choice will allocate a certain percentage of your investment in multiple companies and buy equities.

Thus, it gives you an opportunity to gain more. You shouldn’t forget that, the market gains depend on the market share prices. So, when the share prices are up, you gain more interest and vice versa. However, many research reports suggest that for long-term ROI Equity mutual funds are a good option.

10. Fixed Annuities

Fixed Annuity Plans give a higher interest rate than a regular Fixed Deposit. It is mostly recommended to people close to retirement or who have just received a big chunk of money. Annuity plans allow consumers to receive a fixed monthly income. Fixed annuity plans are a form of assets that generate income monthly.

Now, annuity plans are of two types largely. One starts paying immediately and the other keeps your money for some time, generates interest over it, and then starts paying you a fixed monthly income.

To get the most advantage of this annuity scheme if you are close to retirement, you can invest in multiple annuity plans. This will divide your money. Suppose you bought three annuity plans at the age of 50 years. The first annuity starts paying you when you turn 60 years old, the second annuity starts paying you when you are 60 to 70 years old and the third annuity plan will start the monthly payout at the age of 80. By doing so, you will have multiple backups or pensions generated at different interest rates.

You can do the same for your wife or your children. Just take a little amount of your equity portfolio and invest in annuity schemes. Let them gain interest and then enjoy the benefits. A good financially viable retirement plan.

Other forms of assets that generate income are annuities, dividend-paying stocks, private equity investing, and bonds. For more information on them, head to our blog right here: 16 Best Low-Risk Investments For High Return In India 2023

FAQs: Top 10 Assets That Generate Income In India 2023

What are some of the low-risk assets that generate income?

There are many available assets that generate income. A few of the low-risk assets that make you rich are:

- Renewable energy assets

- PPFs

- Municipal bonds

- Fixed deposits

- Treasury bills

How do renewable energy assets classify as assets that generate income?

In today’s day and age, renewable energy assets are high proving to be high-return assets that generate income. You can invest in renewable energy assets such as solar, hydro, and wind energy by investing directly via :

- Directly buying renewable energy stocks

- Exchange Traded Funds

- Invest in Solar projects and EV infra. With SustVest– you can choose from upcoming projects and begin investing with as low as INR 5000 and yield IRR up to 15%.

Conclusion

This sums up our discussion on assets and liabilities and what are the Top 10 Assets That Generate Income In India in 2023. We hope that now you will be able to start your investment journey with renewable energy, and even lease solar panels, buy a real estate property, or invest in mutual funds. The key is to diversify your investments as much as you can to let the cash flow steady.

If you are looking for a stable low-risk investment option, investing in Sustvest Solar and EV infra projects might just be your thing. Sustvest helps in making meaningful contributions to India’s Environment Sustainable Goals. You too can become a part of it. Check out Sustvest for more information.

Founder of Sustvest

Hardik completed his B.Tech from BITS Pilani. Keeping the current global scenario, the growth of renewable energy in mind, and people looking for investment opportunities in mind he founded SustVest ( formerly, Solar Grid X ) in 2018. This venture led him to achieve the ‘Emerging Fintech Talent of the Year in MENA region ‘ in October 2019.