In your 30s, transitioning from a young adult to a more organized, financially successful individual may feel overwhelming amidst various stressors like student loans, family planning, home-buying, and other lifestyle goals.

However, taking some simple money moves now can significantly improve your financial future. Prioritize creating an emergency fund, contribute regularly to retirement accounts, and pay off high-interest debts.

Additionally, consider investing in diversified assets and educating yourself about personal finance. These small efforts in your 30s will yield substantial benefits in the long run, providing financial stability and security as you approach retirement.

To guide you in shaping your financial journey and fostering wealth growth in your 30s and beyond, we’ve curated a set of recommendations. Incorporate these strategies, focusing on investing to grow wealth, understanding how to grow wealth in India, and exploring diverse ways to grow your wealth prosperity for a secure future.

Let’s learn how to grow wealth in your 30s.

How Much Net Worth Should a 30-something Have?

As you transition into your 30s, your income and expenses tend to increase. It becomes crucial to prioritise your net worth early on to secure future financial goals. According to many experts, a recommended financial milestone for your 30s is to have a net worth approximately equivalent to 50% of your gross annual income.

For instance, if you earn 5 lakhs per year, 3 lakhs in savings and investments can fund your retirement aspirations. Don’t worry. Even saving a small amount monthly can yield substantial returns.

Investing $100 (Rs. 8200) monthly at age 35, assuming an 8% rate of return, could accumulate over $150K (Rs. 1.23 Cr.) by age 65, as per Bank of America.

Now that we have discussed the significance of building your net worth in your 30s, let’s continue by exploring the implementation of Best Investment Plan for Retirement in India – Enjoy Your Retirement can provide a solid footing for your golden years.

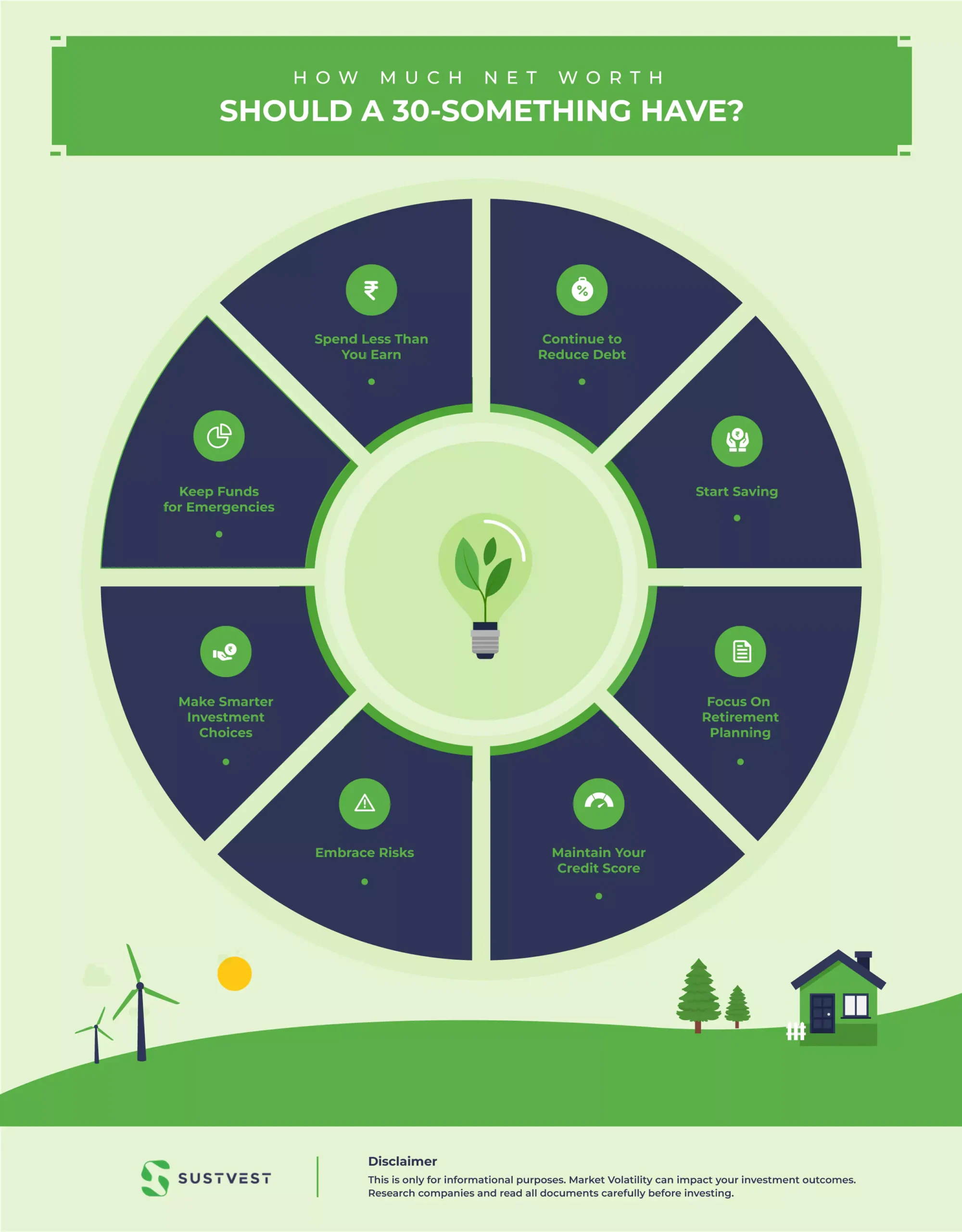

8 Ways to grow your wealth in 30s

Regardless of individual aspirations, the concept of “wealth” varies among people. Whether you aim to become a real estate mogul or desire a secure retirement income, here are eight ways to grow your wealth in your 30s.

1. Spend Less Than You Earn

As people’s income increases over time, they often succumb to lifestyle creep, or inflation, where they start spending more to match their higher earnings.

It’s natural to indulge in non-essential items like a better car, dining out frequently, or buying expensive clothes after years of frugal living.

While enjoying these small luxuries is fine, the issue arises when you prioritise them over your financial well-being.

Sadly, some individuals continue to feel financially strained and struggle to save despite their increased income.

Here are some strategies to prevent lifestyle creep and prioritise spending less than your income:

- Keep a budget: Prioritize paying off high-interest debt and contribute regularly to retirement savings.

- Reward yourself wisely: Opt for smaller indulgences like a nice dinner or a special bottle of wine instead of expensive purchases.

- Avoid comparing yourself to others: Don’t let peer spending influence your own financial decisions.

- Gradually increase spending: Make incremental changes when adding extras, such as focusing on one room or piece of furniture that needs replacement.

2. Continue to Reduce Debt

To focus on wealth-building and eliminate high-interest debt like credit card debt, stick to your budgeted repayment plans and avoid increasing your credit card spending.

Live below your means and reduce your cost of living to free up extra cash for accelerated debt reduction.

Opt for affordable weekend trips to nearby destinations rather than expensive international vacations.

Instead of leasing or frequently buying new cars, challenge yourself to maximise the mileage on your current vehicle in a friendly competition with your mechanic.

3. Keep Funds for Emergencies

To grow your wealth in your 30s, it’s crucial to prioritise keeping funds for emergencies. Set aside a dedicated emergency fund that covers 3 to 6 months of living expenses.

This financial cushion acts as a safety net, protecting your wealth from unexpected events such as medical expenses or job loss.

By proactively saving for emergencies, you can avoid dipping into your investments or going into debt, enabling you to continue to grow your wealth steadily.

4. Start Saving

In your 30s, it’s important to define your financial goals and actively work towards them. Determine the specific objectives, desired amount, and timeline required.

You can calculate the monthly savings and investment contributions needed to achieve those goals by working backwards.

To consistently save, automate the process by setting up automatic transfers from your checking account to a designated savings account every time you receive your paycheck.

This ensures regular savings without relying on manual efforts, helping you make steady progress towards your financial objectives.

Taking into account your personal financial landscape, consider this: What Are the Small Investments That Make Money In 2023? By exploring these options, you can diversify your income sources.

5. Make Smarter Investment Choices

Investing to grow wealth in your 30s offers opportunities to take on some risk, given the distance from retirement.

Consider investing heavily in stocks through mutual funds, ETFs, or index funds for diversified portfolios. Robo-advisors can provide a passive investment approach, selecting investments on your behalf.

As you age, gradually incorporate safer options like bonds. Target-date funds automatically rebalance based on your age.

Whether you are a beginner or an experienced investor, ensure your portfolio aligns with your life stage and financial goals. Investing remains valuable even if you haven’t started yet.

6. Focus On Retirement Planning

As you enter your 30s, financial security for retirement is essential. According to Pew Research Centre, early retirement preparation is important because over half of 55-year-olds have retired.

Maximise your retirement corpus by contributing diligently to your Employee Provident Fund (EPF). The employer’s contribution to your EPF is virtually free money, and both the contribution and the interest earned provide tax advantages.

If your employer does not offer EPF or you wish to supplement your savings, consider opening a Public Provident Fund (PPF) or a National Pension System (NPS) account. These instruments provide additional opportunities for tax-advantaged retirement savings.

Retirement planning involves both saving and investing. If you have significant savings, you may want to consider diversifying your portfolio with alternative assets like Real Estate Investment Trusts (REITs).

Investing in a REIT allows you to generate income from real estate, like single-family rental (SFR) homes. The net income produced from these investments typically remains tax-free, providing potential long-term benefits. By proactively making these decisions, you can grow your wealth and work towards a secure financial future.

Lastly, once you have your gratuity in hand, the question of How to Invest Your Gratuity Amount in 2023? will become crucial. This decision will significantly impact your long-term financial health.

7. Embrace Risks

In your 30s, you have the advantage of time on your side when it comes to investing. With a few decades left until retirement, you’re in a good position to navigate market fluctuations.

Therefore, it’s generally advisable to maintain a higher allocation to equities. Stocks might be riskier than fixed-income instruments like bonds, but they often offer higher rewards.

For instance, over the past 20 years, India’s benchmark index, the Nifty 50, has given an annualised return of 17.5%, which outperforms gold and debt returns at 12.3% and 7.2%, respectively.

Simply holding onto cash and avoiding investments can limit your ability to accumulate wealth effectively. Thus, taking calculated investment risks at this stage of your life can lead to significant long-term financial gains.

8. Maintain Your Credit Score

Having a decent credit score becomes increasingly important in your 30s, especially when considering major financial decisions like buying a house or refinancing loans. Lenders use your credit score to assess the risk of lending you money, which affects the interest rates and terms you receive.

A higher credit score translates to lower borrowing costs, as the mortgage comparison example demonstrates. While it’s ideal for minimising debt, it’s essential to recognise that cash payments for significant purchases are not always feasible.

A good credit score enables you to save money by obtaining more favourable borrowing terms.

By utilising the mortgage comparison calculator, you can assess the cost of borrowing a Rs 250,000 30-year fixed-rate mortgage. Two scenarios were considered based on credit scores:

- Loan 1: Fair credit score (620) with a 4.5% interest rate, resulting in Rs. 2,06,016 in interest payments over the loan term.

- Loan 2: Excellent credit score (800) with a 2.7% interest rate, resulting in Rs. 1,19,804 in interest payments over the loan term.

This example illustrates how having a better credit score can save you substantial money and help you grow wealth.

FAQs: Grow Wealth

What are some key strategies for growing wealth in your 30s?

Key strategies include setting clear financial goals, saving consistently, investing wisely, diversifying your portfolio, and focusing on long-term growth.

Should I prioritise paying off debt or investing in my 30s?

It depends on the interest rates and type of debt you have. Generally, it’s advisable to prioritise high-interest debt while also investing simultaneously to take advantage of compounding growth.

How can I create multiple income streams in my 30s?

Creating multiple income streams can involve various approaches, such as starting a side business, investing in rental properties, pursuing freelancing or consulting opportunities, or generating passive income through dividends and royalties.

Conclusion

Now you must be familiar with how to grow wealth in India. Remember, spending less than you earn and investing the surplus are critical financial habits to cultivate, applicable to investors of all age groups.

However, during your 30s, these habits take on particular importance. As you enter your prime income-earning years, it is an opportune time to grow wealth by bolstering savings, making strategic investments, and creating additional sources of income.

Although expenses may have risen and obligations increased, staying focused on your goals will yield long-term benefits. Start your sustainable investing journey with SustVest to align your investments with your values and contribute to a better future.

Founder of Sustvest

Hardik completed his B.Tech from BITS Pilani. Keeping the current global scenario, the growth of renewable energy in mind, and people looking for investment opportunities in mind he founded SustVest ( formerly, Solar Grid X ) in 2018. This venture led him to achieve the ‘Emerging Fintech Talent of the Year in MENA region ‘ in October 2019.