Don’t work to earn money, but let the money work for you! This infamous quote is not just words but the foundation of investing. Look at any rich personality, there is one similarity in all of them. The rich’s money is not in their bank accounts but in the market; they all have multiple ventures to keep their source of income flourished. But, where should a typical salaried person invest to get assured returns? We understand your dilemma! To help you out here is a list of the top 9 fixed income investing plans in India. Before we begin, let’s understand what fixed income securities stand for.

What is Fixed Income Securities ?

Fixed income securities are a type of investment debt that pay a fixed amount of interest to investors. The interest payments are commonly distributed semiannually, and the principal is returned to the investor at maturity. Bonds are the most common form of fixed-income securities.

Other fixed income securities types include government bonds, corporate bonds, or fixed-income ETFs.

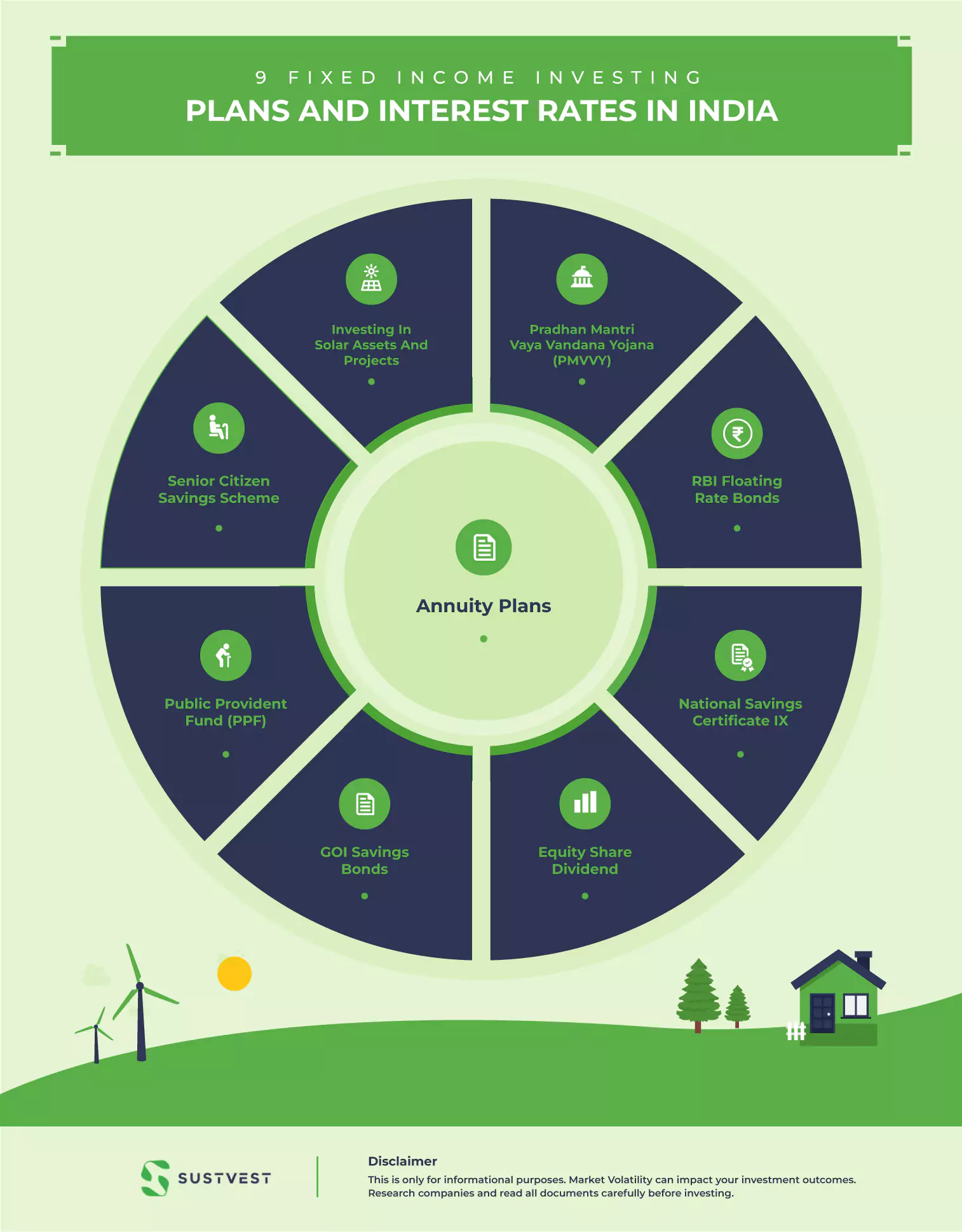

9 Fixed Income Investing Plans And Interest Rates In India

1. Investing In Solar Assets And Projects

The coming years are of solar assets. As per the Global Status Report of 2022, India holds 4th rank all over the world in Solar Power Capacity. At present, the solar power generating capacity of India is 63.3 GW. To take it further the government has approved 59 solar parks of 40 GW across the country.

If there is one sector that is going to see a boom in terms of returns and investments is the solar sector of renewable energy resources. This sector is one of the top fixed income investments in India. The investments are backed by the government.

You can invest in various projects offered by companies belonging to the solar sector. You can either be part of debt funds or become an accredited investor. Your money will be put to work and in return, you will earn extra by fixed income investing.

- Sustvest offers various plans for its investors. You can invest in projects that give out an annual return between 10% to 15%.

- The minimum investment amount can be as low as INR 5000 and the maximum amount can be as high as INR 25 lakhs, or more depending on the project.

- Anybody who has the means to invest can invest in the projects from Indian citizens to NRI, the only condition is a valid PAN and an NRO account.

Investing in solar projects and companies can be one of the best quick-return investments options for you. Read to know Why Invest in Solar Energy Now and some of the other Financial Benefits Of Investing In Renewable Energy here.

Get your answers to how can I invest in solar energy here.

2. Pradhan Mantri Vaya Vandana Yojana (PMVVY)

In the past few years, the government of India has launched several schemes to safeguard the earning potential of senior citizens. Pradhan Mantri Vaya Vandana Yojana is also such a scheme designed for senior citizens of age 60 years and above. This policy is only for a 10-year period.

If you are close to retirement and lookin for a reliable fixed income investing plan, you must check it out!

Overview:

- The maximum investment limit is 15 lakhs.

- The pensioner can give a lump sum amount to purchase the scheme or can make the payment depending upon the mode of pension opted amongst the yearly, half-yearly, quarterly or monthly purchase price.

- The return rate is between 7 % to 9% for 10 years.

- At the time of maturity, the principal amount is paid out, with the final pension and the purchase price.

- In case of the natural death of the policyholder, the amount will be returned to the successor/nominee/heir.

- At any moment, the pensioner can take a loan of up to 75% of the purchased price to aid in emergencies. The loan amount will be charged at interest and will be deducted from the pension at the time of its payment periodically.

- Modes of Pension Payment: NEFT, Aadhaar Enabled Payment System.

- The pension will be paid either monthly, quarterly, half-yearly or annually to the pensioners as per the opted plan.

- The policyholder gets a 15-day free look period to return the policy in case of dissatisfaction or less interest.

- The policy can be bought from https://licindia.in, the whole process can be done online.

- Documents required are Aadhaar card, bank account details, PAN card, age proof, address proof, income proof and retirement proof.

| Mode of Pension | Min. Purchase Price | Max. Purchase price | Min. Pension Amount | Max. Pension Amount |

| Yearly | INR 1,44,578 | INR 14,45,783 | INR 1,000 | INR 10,000 |

| Half-Yearly | INR 1,47,601 | INR 14,76,015 | INR 3,000 | INR 30,000 |

| Monthly | INR 1,49,068 | INR 14,90,683 | INR 6,000 | INR 60,000 |

| Quarterly | INR 1,50,000 | INR 15,00,000 | INR 12,000 | INR 1,20,000 |

3. Senior Citizen Savings Scheme

Another fixed-income investing scheme is to procure retirement benefits and is for people of age 60 years and above. It can also be taken by two people as a joint investment. Not just this, you also get the benefit of tax deduction under section 80 C for the investment made in this scheme.

The maximum amount it caters to is INR 15 lakhs for a maximum period of 5 years at the rate of a minimum of 7% interest charged annually.

It offers assured returns and is not subjected to market risks. So, it is a safe bet for investment in old age.

Overview:

- The maximum amount that can be invested is INR 15 lakhs or the amount received at retirement whichever is lower.

- The accounts can be opened at the post office or authorized bank.

- A tax deduction is permissible up to 1.5 lakhs, but if the amount exceeds INR 50,000, TDS will be deducted.

- The tenure can be extended to 3 more years after the completion of 5 years.

- The deposit limit is INR 1,000 to open the account.

- Premature closing is allowed at a deduction charge of 1.5% for a period of fewer than 2 years. Or, 1% if the account closure is done after 2 years.

- The amount is disbursed quarterly on the 1st of every April, July, October and January.

- Eligibility: for VRS or Superannuation the age limit is 55 to 60 years, for senior citizens 60 years and above and for retired defense servicemen it is between 50 to 60 years of age.

- The application process involves filling up the forms from the authorized bank or PO and submitting it with the required attested documents within one month of receiving the retirement amount.

- Documents required are Adhaar card, voter ID, PAN card, electricity bill, senior citizen card or birth certificate and 2 passport-size photographs.

4. RBI Floating Rate Bonds

The Reserve Bank of India has launched floating-rate bonds which offer a higher return as compared to a regular RBI bond when it comes to fixed income investing. As you know the interest rate on the floating bonds is reset every sixth month, and going with the trend it is increasing.

If you invest in a floating-rate bond, the returns depend on the interest offered by the RBI for that period of six months. After that, the revised interest rate offered by the RBI will be applicable, meaning the interest changes every six months or 182 days.

Recently, the GOI announced the interest rate applicable from March to September 2023 on the Government of India floating rate bond 2033 will be 8.51%.

- The minimum amount that can be invested in floating-rate bonds is INR 1,000, while the maximum amount has no limit. The only condition is that the maximum amount should be in multiples of INR 1,000.

- Eligibility criteria: This bond can be bought by only an Indian citizen, individuals or HUF.

- The tenure of the Bond is 7 years.

- Premature withdrawal or redemption is only applicable to only senior citizens.

- The amount received after the maturity of the bond is taxable according to the applicable tax slab of the Income Tax Act.

- One thing to remember is that these bonds are non-transferable. Also, it can’t be used as collateral to get loans from banks.

- The interest offered by the RBI makes this a safe option for investment with low risks and for fixed-income investing.

5. Public Provident Fund (PPF)

PPF is one of the oldest and safest options a salaried individual has to make some savings through fixed-income investing. It offers longer tenure, above average interest rate and a decent saving amount at maturity. If you are someone who is looking for a low-risk investment scheme, this can be your bite.

Overview:

- The tenure is of 15 years and can be increased in a segment of 5 years.

- The interest rate given is 7.1%.

- The Minimum investment amount is INR 500 and the maximum investment amount is INR 1.5 lakh annually.

- Eligibility: only an individual Indian citizen.

- The bank account can be opened in an authorized bank or Post office to avail govt. PPF scheme. Private banks also offer PPF accounts.

- Document required: Aadhar card, PAN card, ID proof and address proof.

- A premature withdrawal of up to 50% can be made after the compilation of 5 years.

- The PPF deposit should be done once a year for 15 years.

- The opening balance for the bank account is INR 100.

- The account holder can have a nominee.

- The account holder can get a loan of 25% on the amount available in the PPF.

6. National Savings Certificate IX

National Savings Certificate or NSC is one of the low-risk options available for individuals looking for fixed income investing . It is also covered under section 80 C deductions.

Overview:

- The tenure of the NSC is 5 years and 10 years.

- It offers an interest rate of 7% annually.

- The minimum investment amount is INR 1000, which makes it accessible to all of the earning class.

- Eligibility criteria: Indian individuals only.

- A loan can be applied on the NSC amount.

- The interest rate is revised every quarter by the government.

NSC IX was discontinued by the government in December 2015. Presently, only NSC VIII is available.

To calculate the interest on NSC click here.

7. GOI Savings Bonds

GOI savings bonds are issued by the Reserve Bank of India. They are considered risk-free investments as it is regulated by the government itself. The most famous bond is the RBI 7.75% saving bond, which was previously known as the 6-year Saving Bond with an interest rate of 8%.

The IRR of a GOI savings bond is better than a regular fixed deposit for fixed income investing. Take a look at its overview to know more about it.

Overview:

- The new 7.7% savings bonds offer an interest of 7.7% on the principal amount annually.

- The tenure is of 7 years.

- Eligibility: a resident individual, HUF, charitable institutions, any institution with a certificate under section 80G of the IT Act or any university as per the norms of section 3 of the UGC.

- It can be taken by two individuals as a joint bond or a person can choose a nominee at the time of buying the bond.

- The minimum investment is INR 1,000 while the max amount can be any amount in multiple of 1,000.

- This bond can be bought from the Stock Holding Corporation of India Limited office, SBI branches, and a few private banks like ICICI and HDFC.

- These are non-tradable bonds and non-transferable.

- The brokerage fee is given to the authorized brokers at a charge of one rupee for every 100 rupees of the principal amount.

- The maturity amount is taxable as per the income tax slab.

If you can’t cope with the anticipation of the fluctuating interest rates of the market, this fixed income investing bond offers better security and returns.

8. Equity Share Dividend

An equity share dividend is the profit gained by the investor from buying the equity shares distributed by a company. The returns from it can be in the form of either capital appreciation or dividend income. Both are taxable and if the market is stable, offer pretty good returns.

To claim the benefits of this fixed income investing, you need to first buy shares of the company and become a shareholder in its equity. Now, before investing, analyze the pattern and portfolio of the company. Get details of its share values, previous dividends offered, gains and losses, net worth, market share value, etc.

Here are a few high dividend-paying stocks for fixed income investing- GAIL, Tata Steels, Bajaj Auto, Tech Mahindra, Hindustan Zinc, HCL Technologies and JSW Steel Limited.

Equity share dividends offer higher returns than any of the schemes and the investment amount depends on the value of shares at the time of buying as per the market.

So, you can choose the amount you wish to invest. If you are a beginner, start with a small amount and take it further.

9. Annuity Plans

Annuity plans are offered by banks. Under this scheme, any account holder can deposit a lump sum amount in the bank for a period of 5, or 7 years or as offered by the bank at an interest of 6 to 7%. After that, every month a set amount is credited to the account holder.

Now, this scheme is best for you if you have a big amount in hand and you want to generate a monthly income by fixed income investing out of it. So, invest and take a back seat to receive a monthly credit from the bank.

It’s most suitable for retired persons and thus it is the most sought scheme by senior citizens. Parents who want to send a fixed amount every month for their kids, also resort to this scheme.

There is no risk, you can withdraw the amount prematurely. You can also get a personal loan in terms of emergencies.

Banks like ICICI, SBI and HDFC offer a variety of annuity scheme plans. You can choose the best fit for you from them to begin your fixed-income investing journey.

FAQs

What is fixed-income investing ?

Fixed-income investments provide a steady supply of income on a set timetable. However, the amount of the compensation may vary according to the investments.

Who can invest in fixed income securities ?

Anyone who can devote a certain amount of money annually or monthly can invest in these plans. Fixed income investing works best for you if you are a salaried person looking to make profits on the side.

Conclusion

We hope that this article gave you a gist of the top 9 fixed income investing schemes presently available in India. Investments are the only way one can survive in today’s world. With increasing inflation and rising lifestyle standards you can’t stick out to just one source of income. If you are looking for more fixed income ideas, check out 7 best one-time investment plans that give you fixed monthly income.

Investment can seem like a daunting task when you are new to it. We at SustVest can help you take the first step into this giant world of investments. So, choose the best fit from the aforementioned options of investment to multiply your monthly income with fixed income investing. Read here to know how to earn fixed monthly income through investments in India.

Share your views with us and we will guide you further.

Founder of Sustvest

Hardik completed his B.Tech from BITS Pilani. Keeping the current global scenario, the growth of renewable energy in mind, and people looking for investment opportunities in mind he founded SustVest ( formerly, Solar Grid X ) in 2018. This venture led him to achieve the ‘Emerging Fintech Talent of the Year in MENA region ‘ in October 2019.