Imagine a world where your investments not only bring financial returns but also contribute to a sustainable and thriving future for generations to come. That’s the essence of impact investing—a groundbreaking approach that combines the best of philanthropy and investing.

Impact investing — a term introduced by the Rockefeller Foundation in 2007, means combining philanthropy and investing and performing this sustainable investing to make both mutually inclusive.

People invest intending to meet expenses, enjoy retirement, and tackle a medical emergency in the future, essentially for cervical and pleasure. However, at present, we can hardly call Earth habitable.

Yes, on the surface, it is superficial, with tons of amenities to enjoy, But if we don’t control pollution and carbon emissions, we will leave very few resources for future generations to survive.

The concept of impact investing can become a habit amongst rich people like private equity, angel investors, or even individual investors. By Making a significant investment in social and environmental causes, we can boost development and create opportunity so that the sector can thrive and ultimately replace fossil fuels and other non-renewable resources.

In this blog, we will look into the recent investment avenues of impact investing in 2023. Let’s examine each of these five in more detail and answer the burning question.

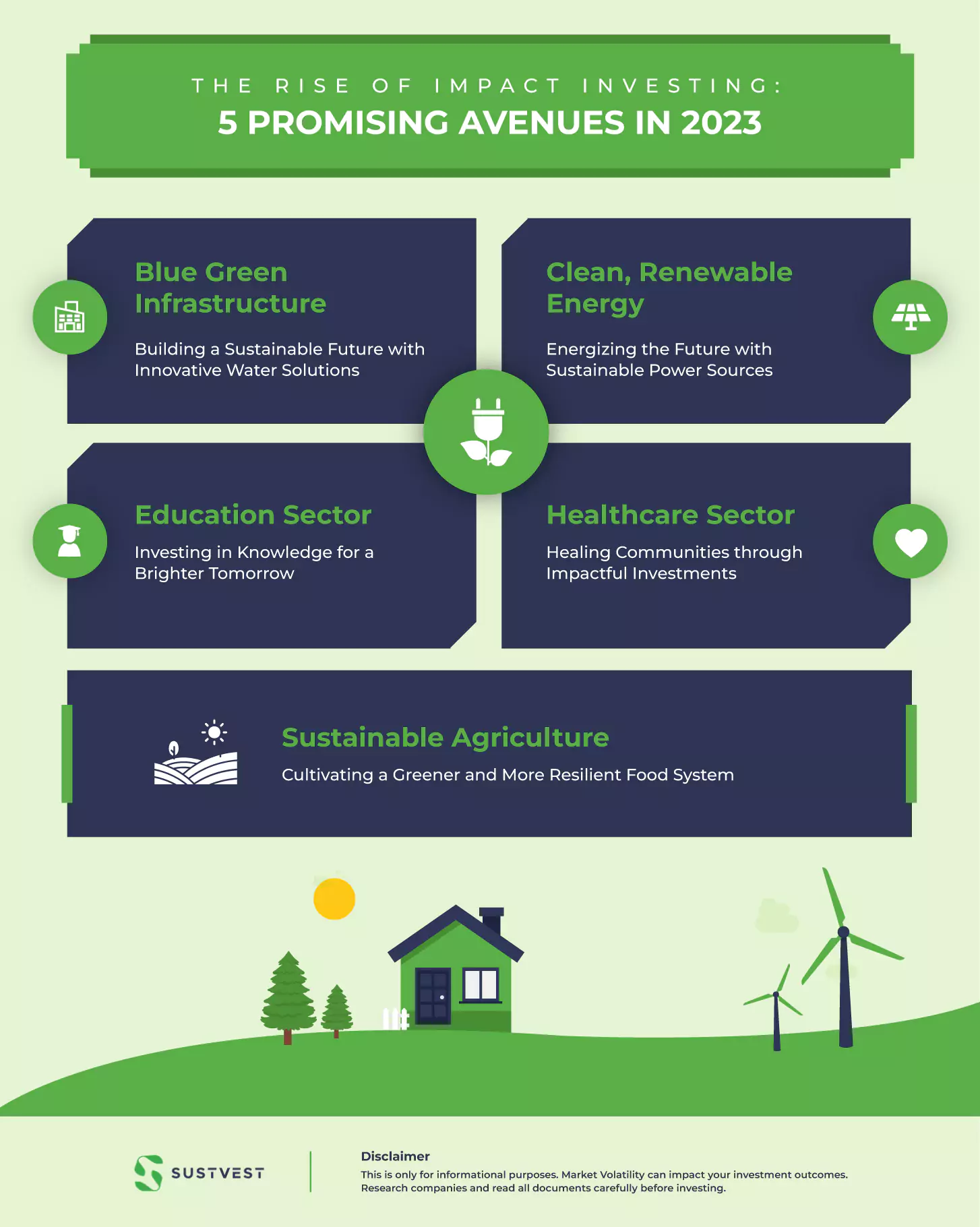

The Rise of Impact Investing: 5 Promising Avenues in 2023

In the post-pandemic era, the significance of impact investments has only amplified.This has led to the emergence of new investment avenues that prioritize not only financial returns but also environmental sustainability. Let’s delve into five recent investment opportunities in impact investing that exemplify this shift towards a more conscious approach.

- Blue Green Infrastructure: Building a Sustainable Future with Innovative Water Solutions

- Clean, Renewable Energy: Energizing the Future with Sustainable Power Sources

- Education Sector: Investing in Knowledge for a Brighter Tomorrow

- Healthcare Sector: Healing Communities through Impactful Investments

- Sustainable Agriculture: Cultivating a Greener and More Resilient Food System

1. Blue- Green Infrastructure: Building a Sustainable Future with Innovative Water Solutions

Blue-Green Infrastructure is a fresh and innovative approach to urban planning and design. It seamlessly combines natural elements with smart engineering to create sustainable water systems.

The term green infrastructure encompasses infrastructure projects that involve parks, green roofs, rooftop solar installations, green corridors, and vertical and horizontal gardens. On the other hand, the blue aspect of infrastructure focuses on water waste control, efficient water management, and water harvesting. Although let’s understand why Blue-Green infrastructure became prominent recently.

Why Blue-Green Infrastructure Investment is the Recent Investment Avenue of Impact Investing?

Blue Green Infrastructure is an underrated investment avenue of impact investing. because it addresses climate hazards and promotes sustainable, inclusive, safe, and resilient cities, as outlined in Sustainable Development Goal number eleven. Now we will explore the Significance of Blue Green Investments through an Indian Lens

Blue- Green Investments in India

Although Blue-Green Infrastructure is still in its early stages in India, cities like Delhi, Bangalore, and Bhopal have started incorporating it into their urban planning.

Several startups in India have successfully attracted private investment for their sustainable initiatives, including:

- SustVest: SustVest is an investment platform specifically targeting renewable energy projects, including solar rooftop installations. They connect individual investors with sustainable energy projects. Offering generous returns of 10-15% to their investors with a minimum amount of INR 15000.

- Ekam Eco Solutions: This company specializes in decentralized wastewater treatment and recycling systems, providing sustainable solutions for water management.

- Uravu Labs: Uravu Labs offers resilient water infrastructure solutions to ensure clean drinking water for residential, commercial, and industrial projects. They utilize technologies like inexhaustible atmospheric moisture and renewable energy sources such as solar and biomass to produce high-quality drinking water.

These startups demonstrate the increasing private investment in and focus on sustainable initiatives in Blue-Green Infrastructure.

2. Clean, Renewable Energy: Energising the Future with Sustainable Power Sources

Renewable energy holds immense potential in addressing India’s growing energy demands, particularly as the country is projected to surpass China as the most populous nation. Furthermore, renewable energy offers a dual advantage by mitigating excessive post-COVID energy demands and gradually replacing fossil fuels by 2070. But let’s dig deeper into technicalities like investment trends in clean energy.

Investment Trends in Clean Energy

It demonstrates the significant attention it has garnered. In 2021 alone, a staggering US$14.5 billion was invested, surpassing expectations. As the dependence on fossil fuels decreases, India is set to revive global energy investments worth $2.8 trillion by 2023, while investment in coal, gas, and oil stands at $1 trillion.

India’s influential and financially robust entities are actively investing in renewable energy. For instance,

- Adani Enterprise has committed to investing $20 billion in renewable energy over the next decade.

- While Mukesh Ambani plans to invest $10 billion in solar and wind energy over three years.

These substantial investments from key players are poised to transform the Impact Investing landscape.

The involvement of such large investors brings confidence and trust to the sector, attracting additional investments from other stakeholders. This infusion of capital will expedite the growth of renewable energy projects and infrastructure.

Moreover, big investors bring valuable expertise, resources, and scalability to the sector. Their extensive networks and experience can drive innovation, improve efficiency, and lower costs. As a result, renewable energy becomes more accessible to retail investors.

Even individual investors can participate in the renewable energy sector by investing in solar energy companies through the stock market and ETFs, offering opportunities for diverse participation in Impact Investing.

3. Education Sector: Investing in Knowledge for a Brighter Tomorrow

Investing in education as an investment avenue of impact investing aligns with Sustainable Development Goal number four is about quality education. Impact investment sustainable development goal also suggests promoting equal opportunities in education for all irrespective of disparities based on gender, social, caste, and creed differences.

Impact investing in education aligns with the social component of ESG, as it supports initiatives that bridge educational gaps, enhance teaching and learning, and ensure inclusive access to quality education for all, contributing to positive social change and empowering individuals and communities for a sustainable future.

Why Is Education Sector One of the Investment Avenues of Impact Investing?

The education sector has become a recent investment avenue for impact investing due to the surge in educational technology (ed-tech) tools during the COVID-19 pandemic. These tools have bridged the education gap and provided urban and rural students with equal learning opportunities. Impact investors have recognized the potential for profitability while positively impacting education.

India will witness impressive growth in demographic dividend in the coming years; investing in quality ed-tech companies will contribute to the country’s growth and shape its future.

Investment Analysis in Edtech

EdTech has witnessed a remarkable rise in India, with COVID-19 acting as a catalyst and propelling Indian ed-tech companies to achieve unicorn status globally.

Over $2 billion invested in the past year and over $5 billion in the last five years. The momentum continues growing as more than 4,500 ed-tech startups operate within India’s thriving startup ecosystem.

4. Healthcare Sector: Healing Communities through Impactful Investments

Healthcare has become a significant investment avenue of impact investing due to its alignment with Sustainable Development Goal 3, which aims to ensure health and well-being for everyone and eradicate epidemics like AIDS, TB, and malaria by 2030.

With its advancements in technology, the healthcare sector has captured the attention of impact investors who seek to generate both profit and social good through their investments.

Why Healthcare Sector Is the Recent Investment Avenue of Impact Investing?

Healthcare has become a significant avenue for impact investing due to its remarkable capability to detect diseases early and provide life-saving treatments.

This ability holds immense potential to improve individuals’ health and well-being, making it an attractive sector for impact investors.

By investing in healthcare, investors can contribute to advancing medical technologies and practices, ultimately saving lives and making a positive impact on society.

But, What Do the Investment Statistics Reveal?

The healthcare sector has seen a surge in investment due to the COVID-19 pandemic. It has attracted significant capital, with $14 billion invested in medical tools, online pharmacies, and virtual apps.

Before Covid, Healthcare tools experienced remarkable growth, increasing 13-fold from $94 million in 2011 to $1.275 billion in 2016. Private investment in the healthcare sector has tripled, reaching $1.5 billion.

These investment figures show the sector’s potential for impact investing and its ability to drive positive societal change.

5. Sustainable Agriculture: Cultivating a Greener and More Resilient Food System

Sustainable agriculture is often considered an untapped investment avenue for impact investing as it does not receive as much investment as other sectors and is not considered a mainstream avenue for impact investing. However, in impact investing, Sustainable Development Goal number two aims to end hunger, achieve food security, and promote sustainable agriculture.

What Is the Difference Between Conventional Agriculture and Sustainable Agriculture?

The main difference between conventional agriculture and sustainable agriculture is that in conventional agriculture, the end result, such as crop yield, is the primary focus. Which often demands intensive use of harmful chemicals and pesticides.

On the hand, sustainable agriculture emphasizes the importance of using natural processes on-site to limit the use of non-renewable energy sources and reduce environmental impact. This means that the processes used in sustainable agriculture are just as important as the end result.

Why Is Sustainable Agriculture the Recent Investment Avenue of Impact Investing?

Sustainable investing has emerged as a recent investment avenue of impact investing due to the growing recognition of the need for more environmentally and socially responsible agriculture. Farmers are paid fairly in this avenue of impact investing, and consumers receive fresh produce without deception.

Private Investment Towards Sustainable Agricultural Startups

Private investment in sustainable agriculture startups has been increasing in recent years. AgriFood startups raised $1.66 billion from 2013-2017 through 558 deals, representing about 10% of global deal activity, which amounted to about $17 billion (Burwood-Taylor).

For example, Humpy Farms, an organic farming startup, has recently secured INR 5 Crore in funding. Humpy Farms practices end-to-end climate-smart regenerative digital organic farming, which helps to reduce its carbon footprint.

FAQs: Investment Avenues of Impact Investing

What is Impact Investment?

Impact investment involves making financial investments with the intention of generating positive social or environmental impact alongside a financial return. The primary goal is to contribute to social and environmental solutions while still achieving a reasonable financial gain. In essence, impact investments seek to align financial objectives with the desire to address pressing global challenges, such as poverty, climate change, or inequality.

How to get started in impact investing in India?

- Research: Understand impact investment opportunities in sectors like renewable energy, healthcare, or education.

- Network: Connect with impact investment organizations, networks, and experts for insights and guidance.

- Financial Advisor: Consult a financial advisor with expertise in impact investing to align your goals and explore suitable options.

- Due Diligence: Thoroughly research potential impact investments, considering both financial returns and social or environmental impact.

Remember to stay informed about the latest developments in the impact investing landscape in India.

The Takeaway: Why Investment Avenues of Impact Investing Will Attract Mainstream Investment in No Time?

As India becomes 3.75 $trillion economy. In light of that achievement, there is a pressing need to make the earth livable for future generations. Thus impact investing may start with venture capitalists, private investors, and equity firms, but it may soon find its way to individual investors.

However, there are only a few e-Mutual Funds and stock options available for impact investing. . But the reach to mainstream investment has started to take the example of sustainable platforms like SustVest.

It focuses specifically on renewable energy projects, providing individuals with the opportunity to support sustainable initiatives while earning financial gains of up to 15%.

Take the time to explore these avenues and make informed investment decisions that align with a more sustainable future.

Founder of Sustvest

Hardik completed his B.Tech from BITS Pilani. Keeping the current global scenario, the growth of renewable energy in mind, and people looking for investment opportunities in mind he founded SustVest ( formerly, Solar Grid X ) in 2018. This venture led him to achieve the ‘Emerging Fintech Talent of the Year in MENA region ‘ in October 2019.